Wealth Management Update September 2023

EXPRESS YOUR WISHES

You may be surprised to know that Personal Pensions sit outside of the wishes in your Will when you die. Instead, Defined Contribution pensions, are distributed via an Expression of Wishes form usually supplied by your pension provider.

Expressions of wishes are requests from clients to their Pension Provider as to how to deal with their Pension when they pass away.

It’s important to let your Pension provider know of any life changes that may affect where you want to send your Pension on death. Such events could include marriage, divorce, or the death of a loved one. Failure to keep these wishes up to date could lead to complications for your executors or family after you are gone.

When you pass away, any named beneficiaries on the expression of wishes can usually select whether to take their share of the death benefits as a lump sum or via Drawdown. However, it is worth remembering that beneficiary drawdown is only available in the following circumstances:

- The beneficiary is classed as a dependent of the deceased under HMRC’s definition.

- The beneficiary was named on the deceased’s expression of wishes.

- The beneficiary is receiving death benefits in a situation where there are no surviving dependents and no expression of wishes in place.

Ultimately, it is the scheme administrator who has the final say over which parties receive death benefits when you pass away.

Whilst the administrator aims to distribute any benefits in accordance with the wishes of the deceased client, without a clear and updated expression of wishes in place, this has the potential not to align fully with your intended outcome.

Many of our clients use Pension Trusts for their Pension death benefit – please take this guide, with our compliments, if you want to learn more please click here.

Please also feel free to contacts us by telephone on: 02920 450 143, or alternatively by email: info@penguinwealth.com.

WHAT IS SJP DOING RIGHT?

If you read The Times, you will have seen the article reporting that after doing their own research, St. James’s Place has confirmed that only 1 in 9 of their funds offer good value.

This is in response to the new Consumer Duty rules that have forced Financial services firms to assess ‘value’.

With £148bn in assets under management, more than 900,000 clients, and over 4,600 advisers, St James’s Place is the biggest wealth manager in the UK. But if even they are confirming they are not offering value for money, and doing seemingly very little about it, it does beg the question, “What are they doing right?”.

Source: The Sunday Times

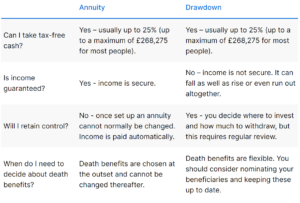

ANNUITY VS DRAWDOWN

When you retire, you normally have the freedom to choose how you take money out of your Personal Pension. You can take your entire Pension in one go if you want. But for those who desire a regular income, the main options are an Annuity or Drawdown, or even a mix of the two. But what is the difference between them?

Source: Hargreaves Lansdown

Both income options have pros and cons, but the majority of investors these days prefer the element of flexibility of being able to change the regularity and amount of their income that Drawdown can offer, so their savings can better support any changes in their objectives and lifestyle.

If you or someone else wants to discuss their Retirement Income options in more detail, then let us know. We also have an extensive guide on Retirement Income Options, to read our guide please click here.

PENSIONS POST-RETIREMENT

You may be surprised to know that you can still pay into your Pension even after you have retired, given up work, or started taking Pension benefits. You can even get tax relief on contributions as long as you’re a UK resident and under age 75.

There are a few rules, obviously, we are dealing with HMRC after all!

- If you have only accessed your tax-free cash lump sum you can still put in the full annual allowance amount of up to £60,000 gross or an amount equal to your relevant earnings for the tax year, whichever is lowest.

- If you have accessed any of your taxable income, then you will be limited to the Money Purchase Annual Allowance (MPAA) of £10,000 gross.

- If you’ve stopped earning any income and are a non-taxpayer, you will be limited to contributing an amount of £3,600 gross.

- If you have taken money from your Pension and want to continue contributing, you need to make sure you don’t fall foul of the tax-free cash recycling rules.

So, why would you want to consider paying more into your pension? A few reasons.

- When you pay money into your Personal Pension, the government will automatically add basic-rate tax relief (currently 20%) – a 25% return on your money.

- Usually, up to 25% of the money you have in a pension can be paid to you Tax-free (up to a maximum of £268,275), and the rest is taxed as income.

- You can pass on your pension to your loved ones (Tax-free in some cases) when you die. It won’t normally be subject to Inheritance Tax.

Pensions are notoriously complex and so before any action is taken you should take advice to ensure you are acting within HMRC rules and regulations and don’t generate any unforeseen Tax charges.

If you want to look into any of these options further, then feel free to get in touch with us.

CGT TAKE ON THE RISE

Those paying Capital Gains Tax (CGT) jumped by 20% in the 21-22 tax year.

A total of 394,000 taxpayers paid a record levy of £16.7 billion, up 15% on the previous year. It was levied on £92.4 billion worth of gains.

This could be as a result of many people being aware of the reductions in CGT allowances on the horizon which led to more disposals of assets to avoid a potentially higher Tax bill. Or even that the surge in house prices during and after Covid led to many buy to let homeowners to capitalise on the gains they made before the markets dropped as well as avoid the increased legislation around owning second properties. Whilst this is all likely true, the reality is that the figures from HMRC showed that most CGT comes from a small number of taxpayers who make the largest gains. In the 2021 to 2022 tax year, 45% of CGT came from those who made gains of £5 million or more, representing less than 1% of CGT taxpayers each year.

The Tax receipts are likely to get larger again as the changes to the allowance come into effect. The allowance halved from £12,300 in the 2022/23 tax year to £6,000 in April 2023 and is set to drop further to just £3,000 from April 2024.

This has led to fears that CGT could be in line for even more change and restriction, and this could also be a reason why people are taking advantage of the rules. As they say, the better the devil you know.

To help mitigate CGT, using your Pension and ISA allowances can be a useful strategy if appropriate. But if your circumstances are more complex, we can offer advice on other ways to better mitigate CGT that may work for you.

Source: HMRC tax receipts and National Insurance contributions for the UK – GOV.UK (www.gov.uk)ease to £322,000 from 26 July 2023.

TOP THREE CASH ISAs

Please check the terms and conditions before opening any account. If in doubt, consult with

your financial adviser directly, as the above is for your information only.

Source: Moneysavingexpert.com 01/09/2023