This is at our expense! Your Discovery Meeting is covered by us with no obligations.

A fixed fee may be charged for the Penguin Planning Process. This may include creating the first draft of your Wealth Management Plan and/or Financial Forecast based on your situation. The Penguin Advice Fee will cover the cost of reviewing your situation, looking at your strengths and weaknesses and delivering impartial, unbiased advice on all the things to consider to improve your Financial position to help you ‘Make Smarter Financial Decisions’.

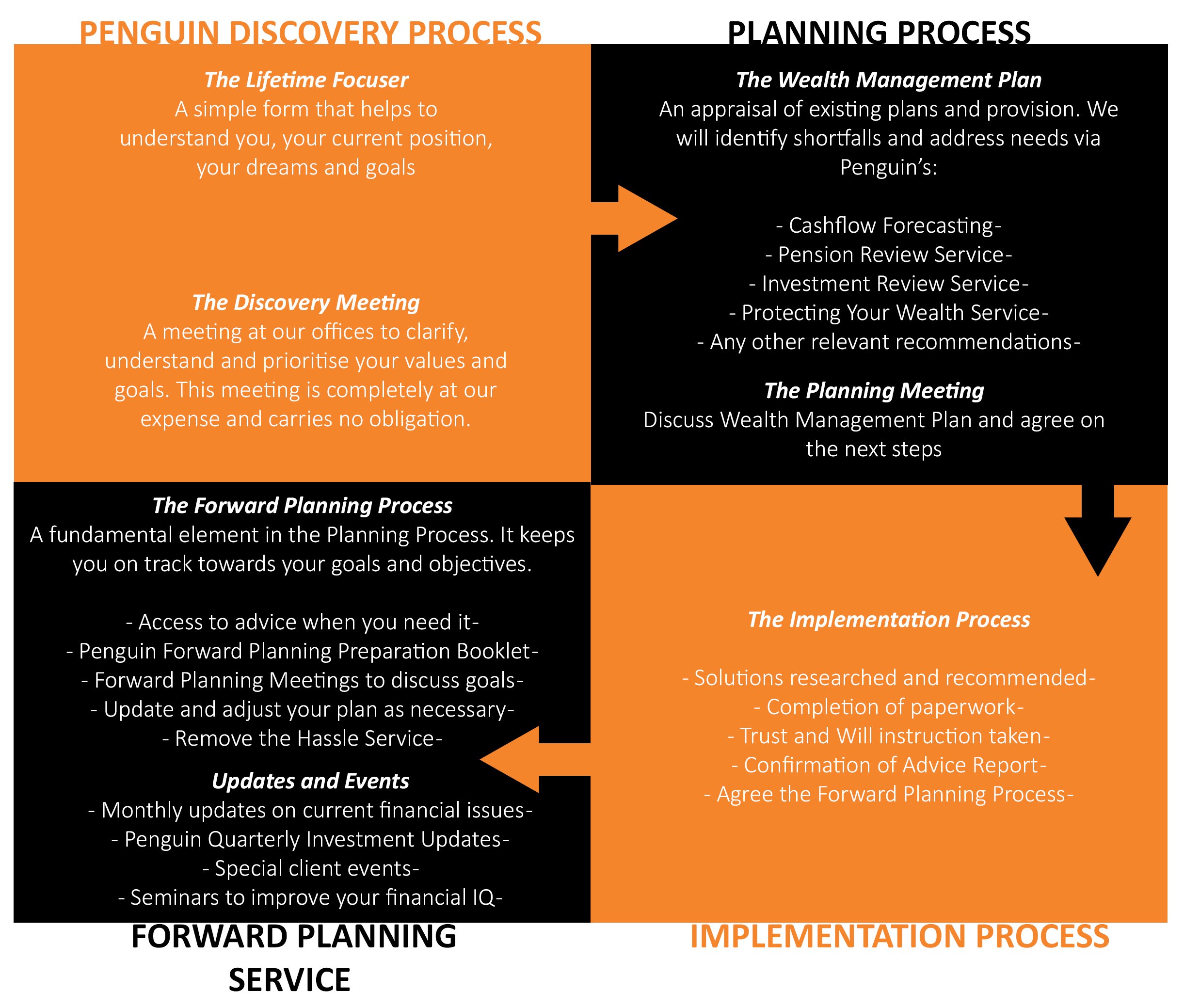

This process will include one or more of the below –

Money Back Guarantee

If you do not feel that the plan we produce and the Planning Meeting has added value to you, then it will come at no cost.

*The Financial Forecast is a service that helps us predict how your Financial future looks based on your current situation and what you are trying to achieve in the future – also called cashflow modelling.

If we decided to work together and a product is recommended then this fee can be taken from your product on Implementation. If this service is selected in isolation, under current legislation, VAT will usually be payable on the amount charged.

A menu of fees will be included within your written document/Plan. This document will detail all fees involved in implementing any advice we may give, including the costs of any Wills and Trust arrangements. Consequently, fees could include activities carried out by specialist third parties.

Penguin will charge a fee of 2% fee on the first £250,000 invested and 1% fee on any remaining investment over the initial £250,000*.

This fee is to cover the risk of Advice, and Regulatory Cost of providing your Financial Advice, and will be taken from the product. The fees Penguin charge for Implementation contribute towards the costs of Regulation, Insurance, Business and Office costs and the risk of Advice to Penguin.

If you invest £300,000 into an Investment plan, for example, you will be charged with £5,000 (2% of the first £250k) and £500 (1% of the remaining £50,000 invested). The combined total fee charged would be £5,500 and will be deducted from the investment and £294,500 will be invested.

* The Minimum fee for any product Investment/Pension we arrange is £500.

You have the option to pay this fee direct to Penguin via online banking or as a cheque and £250,000 will be invested.

To arrange and advise on a SIPP £1,497

To arrange and advise on a SSAS £1,997

Plus 1% of any pension funds moved into the SIPP / SSAS – example £1,000 = 1% of £100,000

To arrange and advise on an Enterprise Investment Scheme (EIS), Venture Capital Trust (VCT), Business Property Relief

Some specialist solution products such as VCTs, EISs, BPR Products will be subject an administration fee of 3% of the fund value due to the complex nature and additional risk to the Penguin business of these products.

For non-investment business such as Term Assurance we will usually be paid a commission from the product provider. This will be disclosed to you in an illustration before you go ahead with our recommendation. We will agree with you the fee or amount of commission we will be paid before we make or implement any recommendations. You will receive a quotation which will tell you exactly how much commission we will receive and about any other fees relating to any particular insurance policy.

There are two levels of service available within The Forward Planning Process:

This entitles you to:

For example, an Investment of £250,000 would pay £2,250 over a 12-month period. As your fund value increases or decreases, our fee will increase or decrease.

This entitles you to:

The following services, when requested, may attract individual fees per project:

Please note: on-going advice, service and prompt adviser availability is not an inherent part of The Customer Relationship Service.

For example, an investment of £250,000 would pay £1,250 over a 12-month period. As your fund value increases or decreases, our fee will increase or decrease.

If you do not want or need an ongoing service from Penguin but would still like to discuss your Financial Planning needs with us on an ad-hoc basis, then we can discuss the costs of this as and when required.

Signup to our mailing list

Receive the latest monthly news, tips, events and financial commentary from the Penguin Team, straight to your inbox.

Contact Us

T: 02920 450143

A:

Penguin House, Raleigh Walk, Brigantine Place,

Cardiff, CF10 4LN

________________

Cowbridge Office

5 Willow Walk , Cowbridge

Vale of Glamorgan, CF71 7EE

Penguin © 2024. Penguin is a trading name of Penguin Wealth Planners Ltd. who are authorised and regulated by the Financial Conduct Authority (FCA no. 830057). For further information please View More

Customer Focus Award

Customer Focus Award