Wealth Management Update – March 2021

Here comes the budget

As we now know the Government’s plans as Chancellor Rishi Sunak outlined the budget for 2021 last week. A second date for your diary is 23rd March. This will be when the Treasury will hold its so-called “Tax Day”. It is expected that long-term tax policy changes will be defined, with a focus on Capital Gains Tax and environmental levies. Details on anticipated future tax rises are also expected, as the Chancellor outlines his long-term ambitions and ideas for generating revenue with the aim of improving the resilience and effectiveness of the UK tax system.

We held a Tax webinar for our clients back in late February and now you can access this too by just clicking here. You will get the webinar sent direct to your inbox and our Tax Allowance checklist that will outline all of the major allowances available to you.

Please be aware that not all the Tax Allowances will be relevant to you so please speak with your Financial Adviser or a member of the Penguin Advice Team if you’d like bespoke Advice tailored to your situation.

If you’d like Craig’s summary on the new budget, please click here to watch the short video.

Lockdown – the exit plan

With a best-case timetable now released for the easing of lockdown restrictions in England, and one due very soon for Wales, and with the first signs of spring in the air, it’s tempting to be cautiously optimistic for the future. With the clocks going forward an hour towards the end of the month we can begin to think about how we might make the most of that extra evening sunlight.

The news of restrictions easing prompted many to make plans for their anticipated freedom. Investors were quick to respond – just one day after the Prime Minister’s announcement shares in the International Airlines Group (IAG – owner of British Airways) rose by 8% and easyJet’s by 11% as the continuing increase in consumer confidence resulted in a surge in holiday bookings. Granted, the share prices later eased back, but optimism was certainly in the air.

Andrew Bailey, Governor of the Bank of England, estimates that pandemic-related personal “extra savings” are in the region of £125bn, with the expectation that these savings will grow further in the first half of this year. The government hopes consumers will start to spend these funds, injecting a much-needed stimulus into the economy to spark a rapid post-lockdown recovery.

If 2020 taught us anything, it’s to err on the side of caution for now.

The final countdown – “Use it or lose it”

We are now in the final full month before the 6th April deadline for “use it or lose it” tax allowances. We covered the main considerations in our February Update but to summarise, the allowances that cannot be carried forward are:

- Personal Allowance – the maximum personal allowance this tax year is £12,500.

- ISA Allowance – everyone has an allowance of £20,000 to invest in an ISA for the 2020/2021 tax year with tax-exempt growth and withdrawals.

- Annual Allowance – you can usually invest a maximum of £40,000 (or the maximum of your total earnings, if lower) into a pension arrangement each tax year, providing you have not accessed your taxable benefits previously.

- CGT Allowance – each tax year you can crystallise gains up to the annual exempt amount with no CGT to pay; this year (2020/2021) it is £12,300.

- IHT Exemptions – an individual has an annual exemption for lifetime transfers of £3,000 per tax year, which can be given to anyone. It can also be backdated by one year if not used in the previous year.

The above is not advice and does not mean that using the Allowances is right for you, so please get in touch with your Adviser for advice tailored to your situation, particularly if you think you may have Allowances that are not currently being used

For richer, for poorer – Navigating divorce at 60+

The intensity of time spent with our significant others over the past year has brought many couples and families closer together, renewing and reaffirming relationships. It’s no real surprise that a baby boom is expected in 2021! However, on the other side of the coin, some relationships have suffered irreparable cracks and, according to the Office for National Statistics, the over 60s, or “silver splitters”, may find they have the most to lose financially should this culminate in divorce.

Keith Richards, CEO of the Personal Finance Society, summed up the financial risks, saying:

“Later-life break-ups generally mean considering more complex financial affairs … It often involves dividing a greater amount of assets — such as the family home, Pensions, maintenance and Tax Planning.”

There’s much to consider financially, from having enough funds in Pension pots to avoid having to return to work, to the Capital Gains Tax implications of the sale of jointly held assets.

As with all Estate Planning, it’s important to state not only who gets what but, more crucially, when. There are Pension Planning options in the case of divorce, such as offsetting, Pension sharing orders and Pension attachment orders (or earmarking), but options and their implications should be explored under the expert guidance of your Adviser.

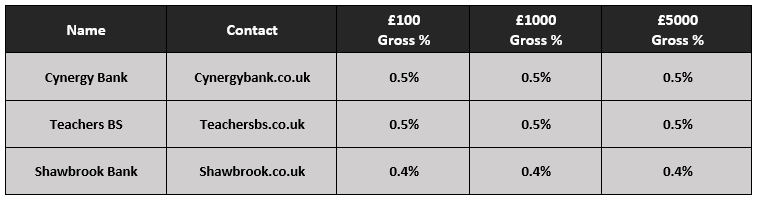

Best Savings Selection

Top three cash ISAs

Please check with the terms and conditions before opening any account. If in doubt consult with your Financial Adviser as the above are for information only.

Source: Moneysavingexpert.com 02.03.2021