Wealth Management Update February 2024

SAFEGUARDING YOUR GREATEST ASSET: A GUIDE TO PERSONAL INSURANCE

2024 is shaping up to be looking a little bit more positive than 2023, and that’s a great direction to be headed in. So, let’s look at the UK economy for this year.

With Inflation having dropped considerably more than the Bank of England first predicted, the hope is that we will see Interest Rates begin to drop by around the end of Q1/the start of Q2, meaning lesser mortgage payments, but also meaning lesser savings rates.

Western economies performed far better in 2023 than anticipated, but many consumers and businesses will probably still face difficult circumstances in 2024.

The Monetary Policy Committee (MPC) kept the UK Bank rate at 5.25% in September, which had increased for fourteen straight months. It was a close call, with five votes against four in the committee resulting in the delay that has kept the Bank rate at its highest point in fifteen years. Then in December 2023, we saw the MPC set monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. The MPC then voted by a majority of six votes against three to maintain the Bank Rate at 5.25%.

Looking at interest rates over the last 50 years, they are not overly high; rather, they are about average. They only feel high because, throughout the last ten or so years, as the world economy has tried to recover from the Great Financial Crisis of 2008, we have only seen fairly low rates.

There is anticipation that inflation will continue to decline, albeit slowly, and that we will probably remain ahead of the Bank of England’s target base rate for some time to come. Now whilst inflation may be declining, prices are still rising, hence we’re seeing the real value of money and clients’ assets are still being impacted. With a lower inflation rate, this will hopefully result in the fall of prices equating to a better cost of living; also leading to real value of money looking better off for the long-term.

SUNAK & SADIQ. HERE TO STAY?

With the UK General Election pending, and the Spring Budget beginning to loom, this may be where we get an early glimpse into the manifesto of the Conservative party.

There has been a lot of speculation on what will be announced, and even more so what Labour may announce to compete against it, but the question many have been asking is, has too much damage been made for the Conservatives to secure their seats for another term?

Bloomberg announced in September that: “A Labour-led government after the next UK election would be the best result for stocks and the pound according to a new Bloomberg survey that shows the ruling Conservatives have failed to win back the faith of global investors.”

It’s a hard question to answer, and one we think will be answered around autumn time this year. Although the election does not need to take place until January 2025, some predict Sunak may go to election the same day as the Mayoral Election – however more are now predicting the General Election to be called in Autumn.

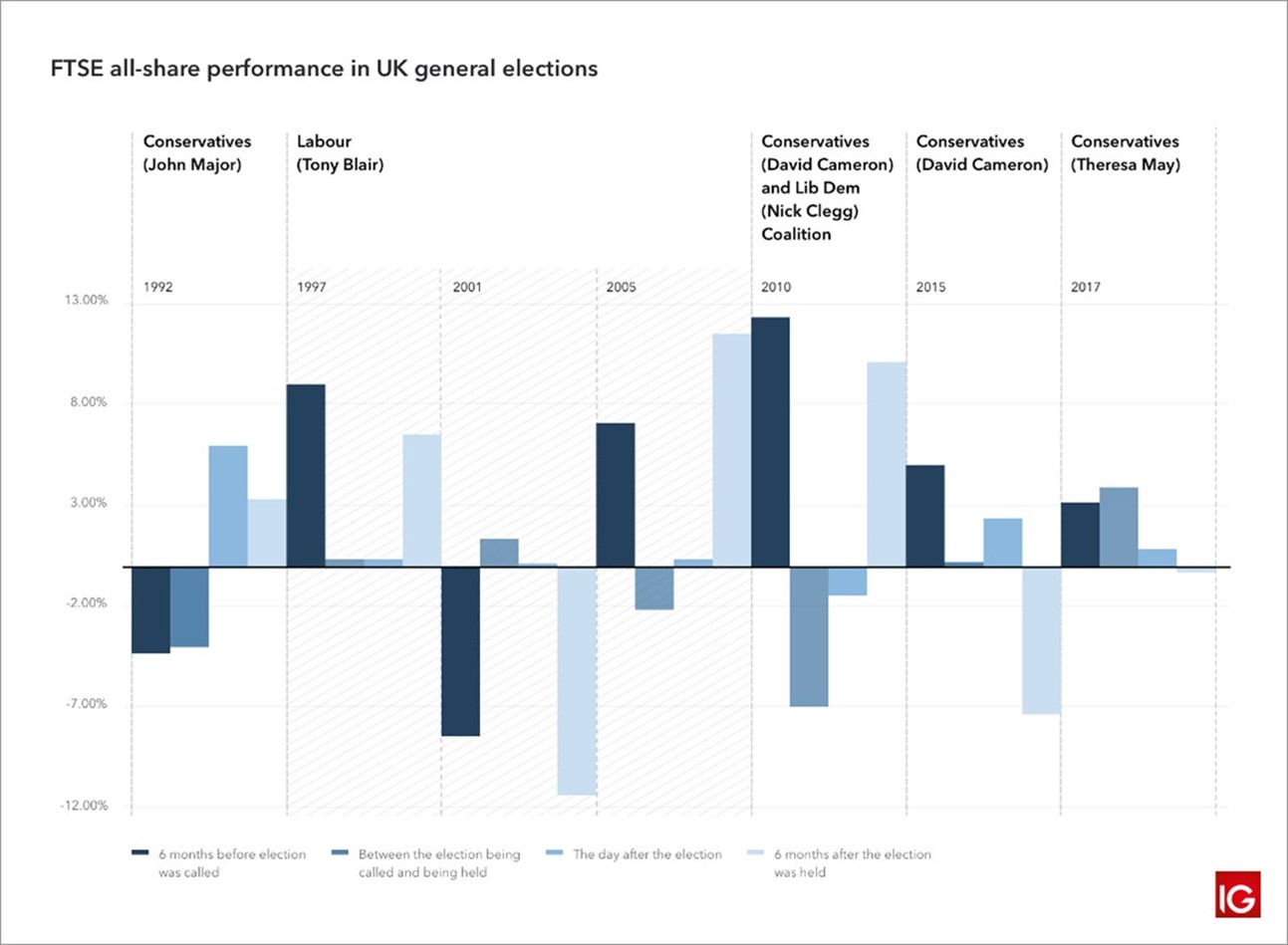

With elections scheduled for 2024 in both the US and the UK, these two nations are gearing up for a politically active year. Election years always affect the markets, either badly or pleasantly, as with any uncertainty.

Before elections, there are usually lower returns and more volatility since investor sentiment is affected by uncertainty. Markets typically rise following the event and with the announcement of the winner, leading to better performance. Strangely, it appears that the markets are strengthened when there is less uncertainty, regardless of who is elected.

Take a look at the graph below to see past effects of the General Election on the UK market:

IS ARTIFICIAL INTELLIGENCE REALLY COMING ON QUANTUM LEAPS AND BINARY BOUNDS?

For me, this is the big one. Artificial Intelligence truly has the potential to completely transform the world as we know it. Whether that be for good or bad, we’re yet to know, but one thing is for sure and that’s the fact that we must prepare ourselves for this new age of technology.

For many, the fear of the bad that could come from unleashing something as powerful as AI could be catastrophic. However, for many others, they recognise the amount of unfathomable good that could be unravelled instead. But how do we avoid all the bad that could come along with the good? Thankfully, last year, we started to see the implementation of bills and legislations across the United Kingdom and the United States; even Rishi Sunak was reported on attending the AI Summit held in Bletchley, joined by Elon Musk. Sunak also stated how he wanted the United Kingdom to be one of the key players in AI regulation, of which, the United States have also started to take steps to ensure these safety measures are taken very seriously.

Something to ease your mind some more, you’re already using AI and you may not even realise. Whether it be your mobile phone using the likes of Siri or Cortana, the hands-free system in your car, or even your Amazon Alexa home pod. These are all a form of AI, and they’re developed to make your life easier. In simple terms, imagine it this way, AI will be here to stay and the easiest way to understand it is that it will hopefully make your life better, and much easier.

But let’s talk finance. How can AI affect your finances? In the short-term, probably not by a lot. It’s not quite there yet to be able to do this for you, but who’s to say where it may be in the next 5 to 10 years, and what the FCA will have to say about it. There are certainly global firms out there using their own models, throwing hundreds of millions at research. The one sticking point for us is it may be well and good to use AI to do so at the click of a button, but will it have the same feel as speaking with another human being and having emotional support throughout the whole process? You could make a Will using AI, but how do you know it is accurate and when it comes to executing that Will, what about the arm around you to give you the support and connection you’d have with a real person to guide you through the process?

To us, authenticity will be a major component missing as AI develops even more. To have a real person working with you, genuinely understanding your needs, and having that human connection and empathy throughout what can often be a vulnerable process to go through.

YES, WE’RE STILL TALKING ABOUT ISAs!

You all have a given ISA Allowance each tax year, and once the tax year ends, any remaining allowance is lost.

We all have a £20,000 ISA Allowance for this tax year (23/24) and for example, if you invest £15,000 into a stocks and shares ISA and nothing into any other type of ISA, then the remaining £5,000 allowance cannot be rolled over to the next tax year.

You have a total of £20,000 across all ISA products; this includes cash ISAs, stocks and shares ISAs, LISAs, etc.

If you want to add more money to your ISAs before the end of the tax year, or if you want to look at setting up any accounts, then please let us know as soon as possible, so we can make sure this can be done before the deadline.