Wealth Management Update November 2023

ISAs, ISAs EVERYWHERE

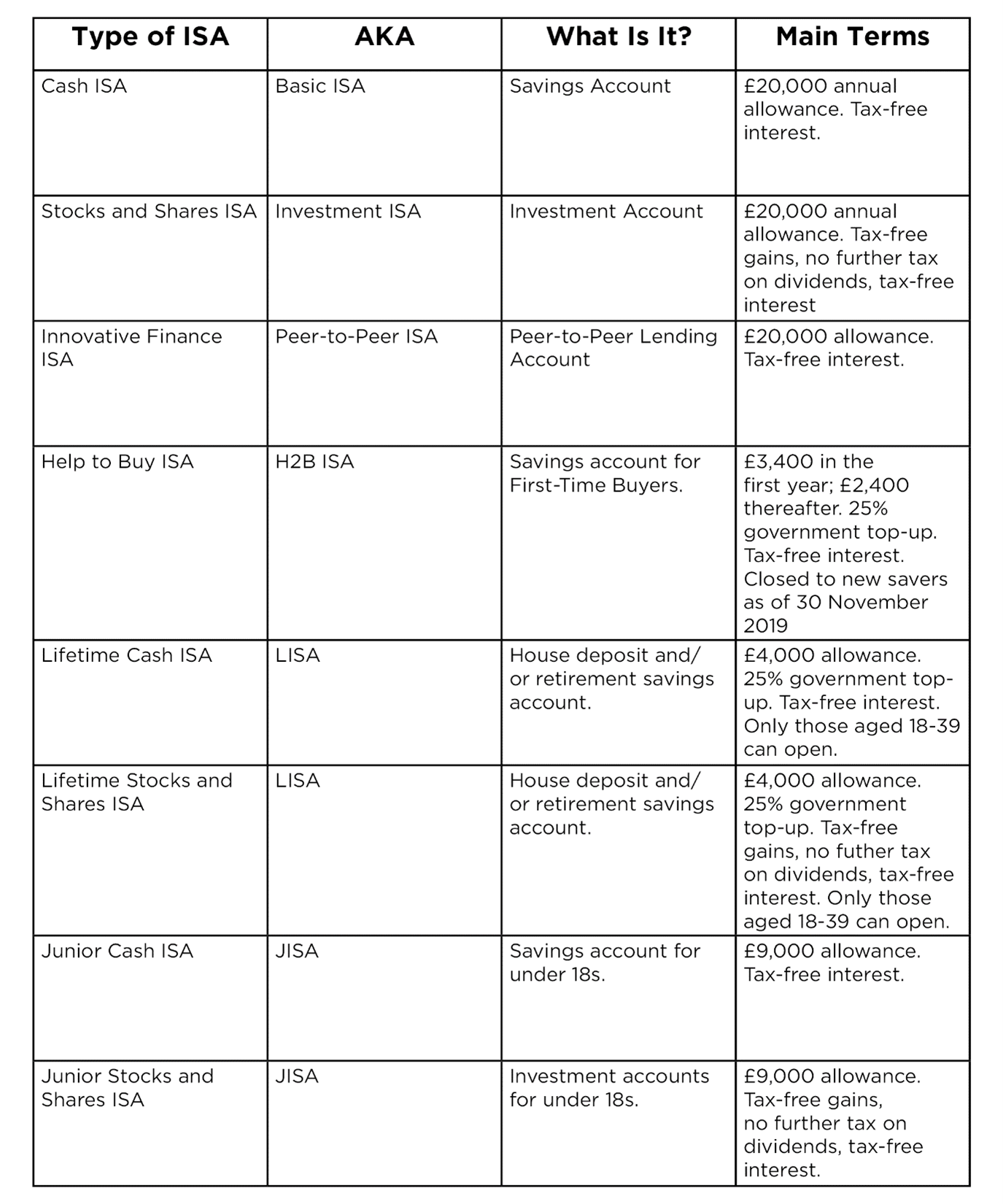

With so many investment products available these days, it can be hard to decide which one is the most suitable for you. This has become more noticeable in the ISA market over the years, and we now have many types of ISAs to choose from. But more choice doesn’t necessarily mean more ISAs, as people become paralysed with the choices on offer.

Many industry experts believe ISAs have become unnecessarily complicated and are calling for the many variations to be scrapped and replaced with one overriding product. As changes like these usually take at least 100 years to come to fruition, here is a reminder of what ISAs you can currently have.

It’s good to remember that whilst you can have multiple ISA products, you only get one ISA allowance per person, per tax year, across all products. For adults, this is £20,000 and for minors, this is £9,000.

For money to be held for the long-term, you should be looking at Stocks and Shares ISAs.

THE RESURRECTION OF ROBIN HOOD

The possibility of a ‘wealth tax’ has been hitting headlines on and off for the past few months, leading to a will they, won’t they argument.

Apparently, according to Labour’s shadow chancellor Rachel Reeves, they won’t. But let’s be honest, we really don’t know what Labour will do if they get into power, as from experience not many politicians ever seem to do what they say they will do.

One thing Labour has promised is that they will reinstate the Lifetime Allowance on pensions. Ignoring the fact that this would create a Financial Planning nightmare for those affected, this would mean that the NHS issue rears its head all over again. The LTA was abolished with the NHS in mind, as senior doctors were retiring early because of tax charges caused by the LTA, creating a concerning workforce problem in the NHS, not ideal. Unless Labour has a different solution then this problem will surely reappear.

Also, is the reintroduction of the LTA, not just a wealth tax under a different name? And why just pensions? Especially when those affected by the LTA is marginal and the income it generates is a drop in the ocean of the country’s economy. As an example, reintroducing the LTA would generate £800m of income per year but the interest alone on government spending is due to come in at 77bn.

If a broader wealth tax was introduced it is projected it could generate £80bn of revenue, so figures not to be discounted. We will have to wait and see how this unfolds, but after everyone has stopped arguing about whether to reintroduce the LTA, they will probably be too exhausted to talk about the possibility of a wealth tax.

Join us for one of our Pension Briefing sessions, where we will be able to gather and discuss any questions or concerns you may have about the changes impacting UK Pensions. We are holding a session over Zoom on Thursday 30th of November at 6pm.

Register your interest here.

Source: professionaladviser.com

STATE PENSION IS RISING

Currently, the state pension age stands at 66. You typically need around 35 qualifying years to get the full new state pension, which is £203.85 a week.

It has now been confirmed that the state pension age will rise to 67 between 2026 and 2027. Another review is set to take place within the next two years to see whether the state pension age should rise further to 68.

To find out the earliest age you can claim the state pension, there is a helpful tool on the HMRC website which you can access using the following link: Check your State Pension age – GOV.UK (www.gov.uk). You can also check what level of state pension you would be entitled to as well as any gaps in your NI history that you may want to fill before you start to claim your pension.

You will need to use your Government Gateway to use the service, but if you haven’t already got one, don’t worry, you can register for one online.

PROBATE DELAYS

It is now taking on average about 14 weeks to get a Grant of Probate, that includes, all scenarios and application types. If you die with a Will (usually recommended), the wait is on average around 18 weeks and without a Will is 23 weeks.

Probate is an extremely complex process and any errors along the way can substantially prolong the process, which is why around half of the applications are completed by legal professionals. It makes sense when you think about it, if you needed a repair done on your car, you’d likely get a mechanic to take a look!

Around 89% of probate applications are now done digitally, which is good news and in theory should speed up the process. However, the wait for digital applications has gone up from an average of 4 weeks last year to nearly 10 weeks this year!

These delays point to potential issues within the systems which likely cause more distress for the families left behind. If you are part of a family that needs help with the probate process, feel free to get in touch with us as we have a team who are experts in this area and will be happy to help.

Source: HMRC

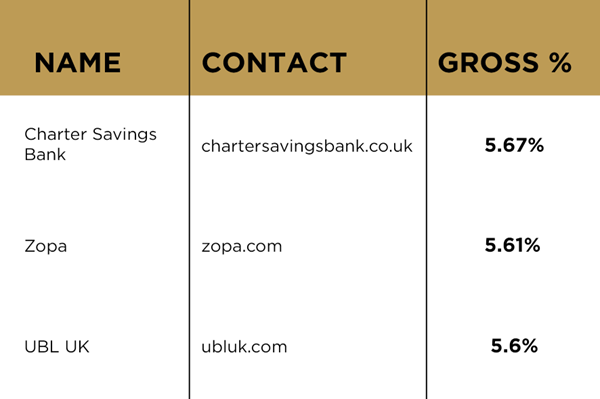

TOP THREE CASH ISAs

Please check the terms and conditions before opening any account. If in doubt, consult with your financial adviser directly, as the above is for your information only.

Source: Moneysavingexpert.com 06/11/2023