Wealth Management Update October 2023

LIFETIME ALLOWANCE LEGISLATION IS LAGGING

After Jeremy Hunt announced the change to the charges around the Lifetime Allowance in the Spring Budget earlier this year, there hasn’t been much movement to finalise the details officially. In fact, this has fallen so much by the wayside that the Association of Consulting Actuaries (ACA) have put pressure on HMRC to get this drafted and distributed by October 2023.

The ACA argue that if the waters around the changes remain muddied then pension members who are affected will have to make decisions around their Pensions without access to the full information.

The announcement and the rules surrounding different scenarios in light of the changes were certainly shared in segments rather than all at once, and it seemed as though they were just making up the rules as they went along at times.

As an example, at the moment, schemes still have to conduct a Lifetime Allowance test on your benefits if you are approaching the age of 75, even though, if you are above the allowance, there are no charges applied. Why? The reason is that the legislation is still in place, but the charge has been removed. Again, why? We can think of no other answer than they like to make life more difficult than it needs to be.

Here’s hoping the ACA can get them to finalise the legislation changes needed so we can all be clear on what needs to happen going forward and we, you, and the Pension providers can stop having to complete unnecessary Lifetime Allowance benefit checks!

Source: aca.org.uk

CASH IS RARELY KING

With interest rates still above 5%, and the markets remaining volatile, it may be tempting to keep more of your money on deposit rather than invest it. However, long term, cash is not always king. In fact, it rarely is as even though interest rates are high, inflation is still higher!

One way to try and get smoother investment results from a volatile market can be to make regular contributions rather than investing in lump sums. This can remove the risk and worry of putting money into your investments at the wrong time.

By making regular payments, you’re buying fewer units when prices are high and more when prices are low, essentially averaging out prices. This is why it’s often seen as a good approach when markets are volatile.

Even experienced investors know that it’s almost impossible to time the market – sell investments just before prices go down and buy them just before they go up. And this is particularly true during periods of market volatility when you could see big rises one day and equally big falls the following day.

Of course, there’s no guarantee that pound cost averaging will result in better outcomes than investing a lump sum. However, ups and downs are part of investing, and no one can say with any certainty when markets will stop rising. So, pound cost averaging can be a useful approach to make sure you don’t buy at the wrong time and are able to take advantage of market volatility.

FAMILY COMES FIRST

Those couples who decide to start a family will likely have an increased number of financial outgoings, which means that financial protections can sometimes be put on the back burner.

Well, here is a reminder of those things you may want to bring up the priority list to make sure your family is fully protected financially.

- If the government offer it, take it. Whether it’s childcare allowances or child benefit, snatch their hand off.

- Protect against the worst happening. Income protection and life insurance are just some of the ways you can, and should, do this.

- Save a buffer. We should all have a savings safety net of 3-6 months’ worth of essential expenses in an easy-access savings account. Easier said than done with little ones.

- Save for THEIR future. JISAs can be a good way to pop some money aside for the kids. You can even ask family and friends to contribute instead of buying yet another toy or t-shirt for their birthday or Christmas.

- Set an example. It’s no good spending or saving all the money for and on the children. Set a good example and get your finances in order. Make sure you cancel all those subscriptions you never use and start saving for when they move out and you get your free time back.

- Ensure there is a will in place guaranteeing that the young children go to the right people if the worst should happen and make certain the Local Authorities don’t decide who looks after them.

LPA’S LEAVE PAPER BEHIND

The Powers of Attorney bill was read and approved in the House of Lords in September.

The bill allowed for the modernisation of the process for making and registering Lasting Powers of Attorney (LPA) and aimed to make it easier for individuals to obtain certified copies of powers of attorney. Basically, it is opening a shift towards digital LPAs, streamlining the entire process which will drastically reduce the processing time.

The hope is that this means it is easier to create an LPA but also that they become better protected from abuse.

Over 6 million Lasting Powers of Attorney are currently lodged with the Office of the Public Guardian – amounting to 7 tons of paper and with 5,700 new applications submitted each day, the current system is undeniably overwhelmed… add to this that there have been frustrations with the service, especially since covid.

Digitisation of the LPA application process is not just relevant to the current challenges and delays we are all currently seeing, but future proofs the service for the younger generations.

For those concerned about the digital shift, there will still be a paper channel for those without internet access or digital proficiency.

From our point of view, it certainly will be nice to give our office printer a break and be able to deal with the many LPA applications we deal with digitally for our clients in the future.

If you need help in this area to arrange this important document, please email us.

Sources: gov.uk & hansard.parliament.uk

BOE STICKS RATHER THAN TWISTS

In September, the Bank rate, set by the Monetary Policy Committee, was unchanged from the previous month at 5.25% after 14 consecutive rises. The Bank rate is currently still at its highest level for 15 years and the pause was the result of 5 votes against 4 within the committee, so a close call.

It’s unlikely that we’ll see rates reduce any time soon, but a pause is still quite a refreshing change from the constant rises. Andrew Bailey, governor of the Bank of England, said: “I can tell you that we have not had any discussion… about reducing rates because that would be very, very premature. Our job is to get inflation down.”

So, what does that mean? Well, it depends.

For those on tracker mortgages, this will be a slight relief, as they have likely seen consistent rises since December 2021. Lenders may now have some confidence to lower mortgage rates, but it’s unlikely to be quick as they will probably be expecting rates to rise again in the future.

For those with credit cards or loans outside of 0% deals, lenders could still decide to put prices up if they expect higher interest rates in the future.

For those with cash savings, there are some good deals on the market already, so you should shop around, as many of you will be on accounts paying little or nothing if the banks can get away with it. Although as we mentioned above, even though many savings accounts are paying more, even the best interest rates aren’t keeping up with inflation.

Sources: bankofengland.co.uk & bbc.co.uk

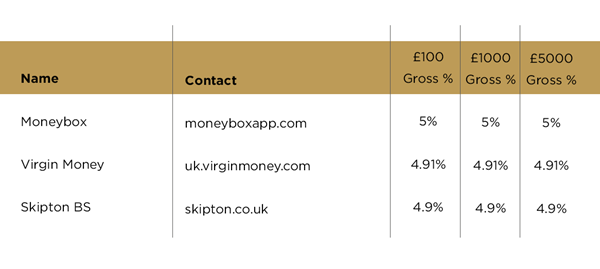

TOP THREE CASH ISAs

Please check the terms and conditions before opening any account. If in doubt, consult with

your financial adviser directly, as the above is for your information only.

Source: Moneysavingexpert.com 04/10/2023