Wealth Management Update July 2023

HMRC gives back

In an unexpected turn of events, HM Revenue & Customs (HMRC) has decided to repay a staggering £1 billion in tax on pension withdrawals.

HMRC recently uncovered a little secret: some pensioners had been overcharged for their withdrawals, oops! It seems the taxman had been a tad too enthusiastic about taking his cut. Instead of keeping the windfall, they decided to do the right thing and give it back.

Adding up all the quarterly figures since 2015, took the total overpaid tax – which has been refunded – on flexible pension withdrawals to around £1.018bn since pension freedoms were introduced.

Under current rules, when an individual first takes money out of their defined contribution pension they are often charged at an ‘emergency’ tax rate, with the duty then being on the saver to claim back overpaid tax by filling in one of three forms. Where an individual does not apply directly to HMRC for a refund, HMRC will work out their annual tax bill at the end of the tax year as part of the usual reconciliation exercise.

It begs the question, why do we have a system which includes consistently over-taxing pension savers who then have the hassle of claiming back the excess tax that they shouldn’t have paid in the first place?

The pension freedoms came in in 2015, we would think that 8 years would be enough to reform the system to match the rules but apparently not. Until HMRC get their act together, apologies if this happens to you when you come to access your pension, we will support you to reclaim the tax, but sadly, there is very little we can do to prevent this from happening proactively – if you would like our assistance please do not hesitate to contact us.

Lasting Power of Attorneys.

What’s an LPA anyway? Well, an LPA is a legal document that allows you to appoint someone you trust, known as your attorney, to make decisions on your behalf if you become unable to do so in the future. These decisions can cover areas like your finances, property, health and welfare. It’s like having a backup plan for when life throws you a curveball.

There are two types of LPAs. First up, we have the Property and Financial Affairs LPA, which gives your chosen attorney the authority to handle your money, pay bills, manage your bank accounts and even sell your property if necessary. Then we have the Health and Welfare LPA, which allows your attorney to make decisions about your medical treatment, care, and even where you live. It’s all about ensuring your wishes are respected when you can’t make those choices yourself.

You need to be mentally capable to create an LPA. Once you lose mental capacity, it’s too late, and the court may have to step in. So don’t wait until it’s too late! Get it done while you still can.

Choose your attorney wisely. Your attorney should be someone you trust implicitly, as they’ll have significant decision-making power on your behalf. It could be a family member, close friend, or even a professional. Whoever you choose, make sure they have your best interests at heart and will act in accordance with your wishes. Trust is key!

You can specify instructions and restrictions. LPAs aren’t a one-size-fits-all affair. You can customise them to reflect your preferences. You can specify instructions on how you want certain matters to be handled, and you can even set restrictions on what your attorney can or cannot do. It’s your way of maintaining control over your affairs, even if you can’t manage them yourself.

Register, register, register! For an LPA to be valid and effective, it needs to be registered with the Office of the Public Guardian (OPG).

Take the time to understand LPAs, choose your attorney wisely, and get that registration sorted. It’s all about planning ahead and protecting yourself for whatever life may throw your way.

If you haven’t arranged this yet, please do not hesitate to contact us.

Probate delays

Due to a decrease in staff at the probate services, there are concerns that there could be delays in probate being granted.

There are some things you can do before you die to make your probate process easier and release assets sooner, to help those you leave behind.

- Wills: If you die without a Will, the probate process can be even longer.

- Life Insurance in trust: Setting up a life policy under trust means it isn’t considered part of the estate and can be paid out before probate is granted.

- Joint accounts: Having joint accounts also means that there can still be access to funds as all the money will go to the surviving partner without the need for probate.

Pension nomination: Pensions are not normally part of the estate, but you should check that expression of wish forms have been filled in, so no delays are encountered.

When will the stock market move?

As we write this, the FTSE100 stands at 7569. This is the same level as January 2018. This means that there has been no capital growth in the index for over 5 years! So what’s going on? And more importantly, when will it change?

Hindsight is easy, and we know that the Pandemic, uncertain political leadership, abnormally high inflation and Brexit are the main causes in the FTSE’s poor results. In hindsight, we should have all moved every investment to the US and accepted the higher risk of the exchange rates. However, who knew that the UK political landscape would be so mad? Who knew that the UK would vote for Brexit and who knew about the double lockdown of covid?

So when will it change?

It really depends on two things: inflation and politics.

When inflation is high, companies have higher costs and cannot always pass that on to customers and so margins are squeezed, thus share prices go down. When you have political uncertainty, investment into the UK falls because people are scared of what happens. As they pull money out of the UK markets or no new investments get put into the

UK, the reduced demand and increased supply drives down the stock market. Therefore, for the markets to increase we need the following to happen:

- Inflation to fall, probably to below 4%

- The government to show leadership

The first will probably happen in the early Autumn unless anything changes. However, when it comes to political leadership, who knows? Do you see real leadership from the UK government? Do you see real leadership in the opposition? We fear that we do not, and we cannot see real leadership coming any time soon.

It’s all about the charges

In times when performance of investments is tough, we have to look to other ways to produce returns, and the easiest alternative is to look at charges.

If one firm charges, say 1% and another say 2%, there will be a difference in returns of about 1%, however, the compounding nature of returns means that in the second year, the advantage will be more than 1% gain, because you will have had the new lower charges applied to a higher figure. Over a ten-year period, the lower-charging firm will have made about a 10% greater gross return just because of that lower charge.

This is the reason why; we are presently on a drive to reduce your charges. The overall investment charges are now lower than this time last year, and in the coming months, we hope to be able to share with you even more reductions, as we look at working with new partners. Watch this space.

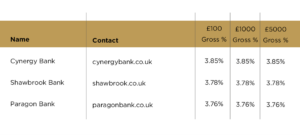

Top three cash ISAs

Please check the terms and conditions before opening any account. If in doubt, consult with your financial adviser directly, as the above is for your information only.

Source: Moneysavingexpert.com 28/06/2023