Wealth Management Update April 2023

BANK OF ENGLAND WARNING

The Bank of England (BoE) warning, below, comes after interest rates rose to their highest level in 14 years, up to 4.25%.

Andrew Bailey, the bank’s governor, has warned that if prices keep being set at high levels and inflation continues to go up, interest rates will need to rise even further, which in the long term will not benefit anyone. For example, as interest rates rise, those with tracker mortgages will see an immediate increase in their monthly payments.

The BoE has been steadily increasing interest rates as it tries to make borrowing money more expensive and encourage people to spend less, with the aim of stopping prices from rising so quickly.

Despite all this they are still confident that inflation is likely to drop sharply this year and Andrew Bailey, the bank’s governor, has said that the risk of recession for the UK “has gone down quite a lot”, adding that the prospects for economic growth are “now considerably better”.

He was also confident that the UK banking system is not under threat in light of the collapse of 2 US banks, and the rescue of one Swiss lender; although, he did confirm that they are being very vigilant and alert to the situation, which is certainly good to hear!

HAVE YOU GOT EXCESS INCOME?

Making gifts out of your excess income can be a useful tool to avoid Inheritance Tax (IHT), assuming it’s suitable for your situation.

There is no limit on excess income lifetime gifting, and it is IHT exempt, meaning it is outside of your estate for IHT purposes rather than having to wait the usual 7 years, providing HMRC conditions are met. The excess income transfer can either be gifted directly or can be made to a trust arrangement, and invested or loaned to any of your beneficiaries, to add a layer of protection and control to the funds as you could act as trustees alongside your beneficiaries.

To make any form of gift you must be willing to relinquish all access to the funds yourself, whether they are gifted directly or into trust.

A gift will benefit from the exemption providing three conditions are met:

- The gift was part of regular expenditure (usually regularly over 2 years or more).

- The gift was made from income (not capital).

- You (the donor) retain sufficient income to maintain your usual standards of living.

Other IHT exemptions in addition to excess income, which are also not subject to the 7-year gifting rules, include:

- Annual Exemption – You can give gifts or money up to £3,000 to one person or split the £3,000 between several people. You can carry any unused annual exemption forward to the next tax year – but only for one tax year.

- Small Gift Allowance – You can give as many gifts of up to £250 per person as you want each tax year, as long as you have not used another allowance on the same person.

- Gifts for weddings or civil partnerships – Each tax year, you can give a tax-free gift to someone who is getting married or starting a civil partnership. You can give up to £5,000 to a child, £2,500 to a grandchild or great-grandchild, and £1,000 to any other person.

We can help recommend and implement gifting strategies for you, so feel free to get in touch to speak to one of the Team.

EVERYONE’S TALKING ABOUT THE… BUDGET!

You will all have seen the recent budget announcements, but we thought we would lay out the most relevant ones here for you.

Pensions

Hunt has made some dramatic changes to pensions, with the intention to encourage NHS doctors, consultants, and other high earners to remain in the workforce for longer. He announced that he would implement the following, as of the new tax year 23/24:

- Abolish the Lifetime Allowance (LTA) tax charge, fully abolished by 2025.

- Increase the Annual Allowance from £40,000 to £60,000 per year.

- Increase the Money Purchase Annual Allowance from £4,000 to £10,000.

- Cap the tax-free cash (also known as a Pension Commencement Lump Sum – PCLS) at 25% of the current lifetime allowance except where protections apply; £268,275 in real figures.

- Increase the adjusted income level required for the tapered Annual Allowance to apply from £240,000 to £260,000.

What does this all mean for you?

We can’t be sure how long these new rules are here to stay, and the changes could be reversed if a new government were to be appointed.

This means, you need to think about your pension in the context of the new rules, which as you can imagine, are more complicated than the press or government have made it sound.

We will be in touch with clients to arrange to speak to you if we think you need to take any action. If you want to speak with us sooner, or you would like to discuss your current position, please do not hesitate to contact the Team.

Other changes

A few other bits to be aware of:

Capital Gains Tax – The CGT annual exemption will be cut from £12,300 to £6,000 from April 2023, and to £3,000 from April 2024. It is important to note that different rates apply to residents and non-residents, personal representatives, and trustees.

Additional rate taxpayers – The point at which additional rate tax becomes payable will be cut from £150,000 to £125,140 from 6 April 2023. This will mean that those already paying tax at 45% will pay an extra £1,243 in 2023/24.

Dividend allowance – The dividend allowance is to be halved from £2,000 to £1,000 for 2023/24 and halved again to £500 for 2024/25.

State pension – The triple lock on the State Pension is maintained, guaranteeing the 10.1% CPI-based increase for next April.

Corporation tax – This will be increased to 25% from the 2024 financial year.

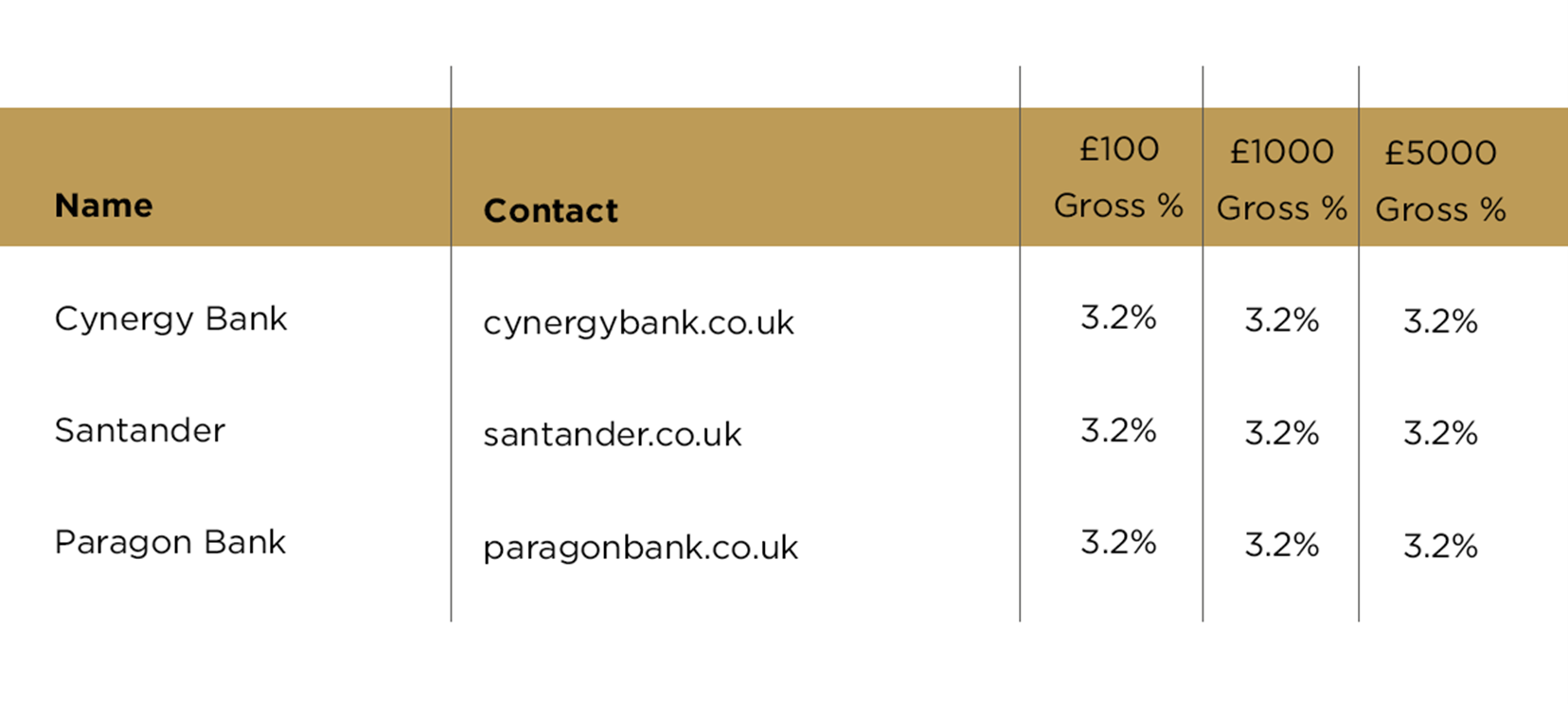

Top three cash ISAs

Please check the terms and conditions before opening any account. If in doubt, consult with your financial adviser directly, as the above is for your information only.

Source: Moneysavingexpert.com 27.03.2023.