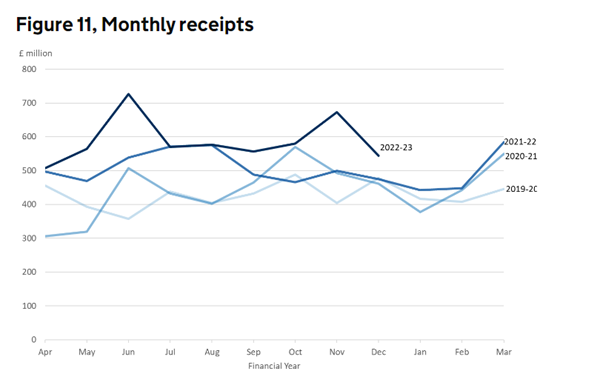

| INHERITANCE TAX SET TO BREAK RECORDS

The Inheritance Tax (IHT) paid between April and October 2022 was £4.1 billion, which is 14% more than the same period in 2021, and has put the UK on track for a record-breaking IHT haul for the 2022/23 tax year.

It should come as no surprise really, when you think that the nil-rate band of £325,000 – the size of the estate that can be left without having to pay IHT – has been frozen since 2010 and will remain frozen until 2028, just shy of two decades! When you consider that the average price of a house in the UK has pretty much doubled since 2009, the impact of freezing of the allowances just keeps growing, and with it, the amount that people pay in IHT.

In light of all this, there is basically no chance that the government will be looking to reform the IHT system to make it more favourable, unless it’s to increase the tax rates. Fingers crossed that is not the case!

Luckily there are legitimate ways to reduce your IHT liability, and it’s something we have been helping our clients with for years. This really is a complicated area that requires expert advice and planning.

HOW TO SAVE FOR THE NEXT GENERATION

It is never too early to start saving on behalf of your next generation and many of you will have already started your families on their savings journey.

How you set up these investments, depends on who you are saving for and why, but here are some examples of routes you could take if you want to start saving for children or grandchildren under the age of 18:

ISAs & JISAs

Junior ISAs are individual savings accounts specifically for children. Unlike adult ISAs, anyone can pay into them (rather than just the account holder), but an annual subscription limit applies which is currently £9,000 (2022/23).

JISAs can also receive transfers of an existing Child Trust Fund (CTF).

Pensions

We tend to think of pensions as primarily ‘adult’ investments, but you can open a pension for a child or grandchild at any point.

The main benefit that a pension brings to the table, is the tax relief that can be claimed on contributions up to a certain limit. The amount that can be contributed into the pension, and be eligible for tax relief, is restricted to the lesser of 100% of relevant UK earnings or £2,880 (net). For children, £2,880 is likely to be the total that can be contributed, assuming they aren’t earning more than this at such a young age. HMRC will then add tax relief to bring the total gross contribution to £3,600 – A 25% return overnight.

As with a JISA, anyone can pay into a pension, assuming the contributions limits aren’t exceeded. It is also worth bearing in mind that any fund held within the pension cannot be withdrawn until the individual reaches their normal retirement age. This may be useful if, for example, you want to give the funds away but are concerned about them being (mis)used at 18.

Trusts

There are different types of trust arrangements available, depending on how you would like the funds managed and what type of access you want your beneficiaries to have.

There are no limits as opposed to JISAs, so larger amounts can be paid in. A gift will mean that it could be outside of the settlor’s estate after 7 years, for Inheritance Tax purposes.

Whichever option is chosen, one thing is for sure, the earlier we invest for the next generation, the stronger the foundations will be for an independent and wealthier adulthood.

WHAT IS THE COST OF RETIREMENT?

With inflation at its highest point in years and the cost of living continuing to rise, the amount needed to provide a ‘comfortable’ retirement is increasing.

For example, the minimum cost of retirement is up by about 20% from 2021 to 2022 meaning that a single person would need to spend:

£12,800 a year to enjoy a ‘minimum’ standard of living in retirement

£23,300 a year for a ‘moderate’ standard of living in retirement

£37,300 a year for a ‘comfortable’ standard of living in retirement

This is assuming you are living rent or mortgage free!

If you retire at 65 and live until you’re 85, to get a comfortable standard of living, you’ll need to have a retirement pot worth at least around £750,000, per person!

Do you know how you are going to achieve that? If not, then it makes sense to seek professional guidance on your finances, both short and long term. The tools, knowledge and expertise of Financial Planners is vital in ensuring that you get the retirement you have worked hard for. Yes, there will likely be a cost, but as Warren Buffett once highlighted, “Price is what you pay; value is what you get.”

And there is certainly priceless value in achieving the retirement you deserve.

STATE PENSION AGE REVIEW IMMINENT

With recent data suggesting life expectancy has stalled, the question posed by many is, should the state pension age follow suit?

Maintaining the current proportion of the population living up to, and beyond, state pension age would require an increase to 68 by 2034, 69 by 2038, and 70 by 2042.

On the other hand, ensuring one-third of adult life is spent in receipt of the state pension would push back the planned increase to age 67 to 2040 – but cost the Treasury billions of pounds.

As always, politics is clouding the decision-making. A dramatic acceleration of existing plans would risk electoral oblivion, while pushing back planned rises could cost the Exchequer tens of billions of pounds.

In reality, younger savers need to prepare for a world where the state provides less of their retirement income than it has done historically. Indeed, it would not be surprising if those in their 20s and 30s today, have to wait until their 70th birthday or even beyond to receive the state pension.

The fact that we don’t know precisely how long the Government intends for people to be in receipt of the state pension, it makes it difficult to predict the outcome of the review, so we will just have to wait and see.

EVERYONE’S (STILL) TALKING ABOUT INFLATION

Andrew Bailey, the Bank of England Governor, has confirmed that inflation is likely to fall rapidly this year, confirming what we had previously predicted; that the factors affecting such high rates of inflation are merely temporary and a product of the tumultuous few years we have had.

A major component of inflation has been the soaring energy costs; as economies recover from Covid, Russia’s war in Ukraine pushes up oil and gas prices.

In November, the Bank of England forecast that inflation would fall to 5.2% by late 2023, and Mr Bailey stuck to that view. The Bank is due to publish new forecasts next month.

Meanwhile, markets predict interest rates will peak at 4.5%, and the Bank is not steering them away from that.

Last October, markets expected UK interest rates to peak as high as 6% but expectations are now for the Bank to raise its main interest rate to 4% from 3.5% in February – which it did.

I’m sure we will all still be talking about this next month, so see you again for another update in March.

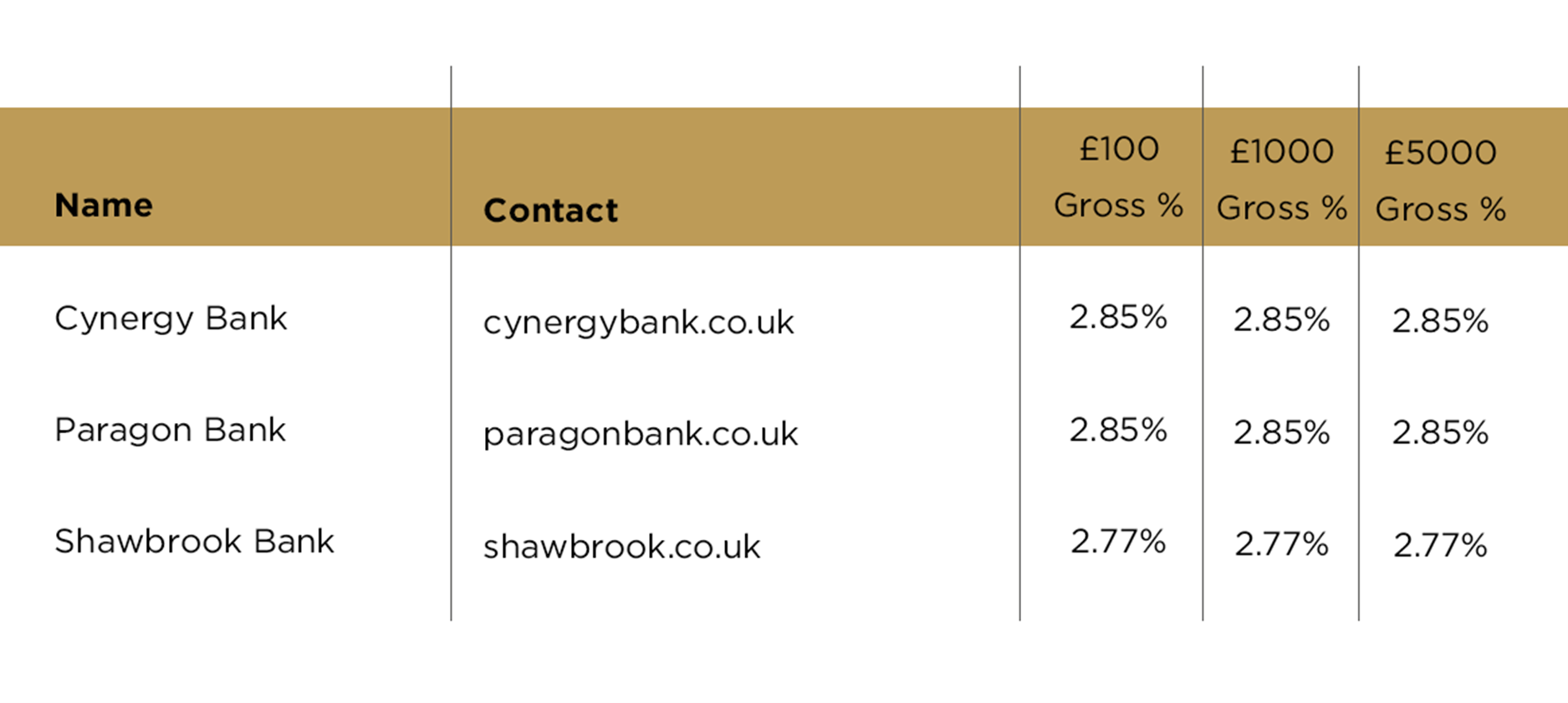

Top three cash ISAs

Please check the terms and conditions before opening any account. If in doubt, consult with your financial adviser directly, as the above is for your information only.

Source: Moneysavingexpert.com 30.01.2023. |