Wealth Management Update December 2022

WHY DO WE ALL NEED PRIVATE MEDICAL INSURANCE (PMI)?

Why do we all need Private Medical Insurance (PMI)?

We are lucky to have the NHS but sometimes time isn’t on our side and treatment is needed quicker than the NHS is able to deliver.

Due to this, we are seeing more demand for Private Medical Insurance (PMI) especially since the announcement on current waiting times for cancer treatment.

To summarise a recent article from the BBC news website – in Wales, 43% of patients don’t start treatment following a cancer diagnosis within the 62-day NHS target. It’s only slightly better in England at 36%.

That means, on average, around 40% of patients must wait more than 2 months for treatment to commence. This delay could mean the difference between a full recovery or sadly, the worst possible news.

PMI is not just for cancer cover though. Over the years, our clients have been able to use their PMI for knee operations, physio treatment, cancer screenings, mental health support and heart investigations, to name but a few.

So, what exactly is Private Medical Insurance?

There are different levels of PMI cover at various premiums (costs), depending on an individual’s needs, and its purpose is to pay for treatment of acute conditions outside of the NHS.

It does not cover treatment of accidents and emergencies, or any conditions deemed as chronic – cancer cover is not deemed chronic, hence the rise in demand for PMI to include this cover.

It also gives you more choice of hospitals and access to more specialists/consultants around the country.

If you would like to speak to our Advice Team to understand PMI further, please don’t hesitate to contact us on 02920 450 143 or email info@penguinwealth.com.

PS. You can read the full BBC article here – BBC News Health

PPS. If you have an Investment with us, many clients take Income from these to pay for PMI…

THE ECONOMY IS NOT THE INVESTMENT

You will see in the media endless droning on about the UK and the world going into recession, and how bad this will be. And we probably are in a ‘technical recession’ now and will probably stay in recession for the next year. This wasn’t unexpected, after all, we predicted it 12 months ago.

What is interesting is that the economy is not the investment.

We have all seen a dreadful couple of investment years. The pandemic, followed by the Ukrainian War, has hit investment markets everywhere. However, what we have seen in the last month or so is a change, with investments turning for the better.

What history tells us is that investment markets are a leading indicator of the global economic situation, and generally lead economic markets. If this is the case, the economy may be going into recession, but the markets have already priced this in. This means that the markets may see a bounce as we go into recession. We believe this is why we have started to see the investment markets turn.

And so, don’t get worried about the markets. Turn off the news and read a good book. We recommend books every month (sign up to our emails!) so give one a try. It really will be better than watching the negative news.

NEVER TRUST A POLITICIAN

A couple of Chancellors ago (there are too many to remember now), the government gave a commitment to increase the Lifetime Allowance in line with inflation. The Lifetime Allowance is the maximum that you can have in pensions before you pay a penalty of 55% tax. We know it seems unfair to those who have saved hard, but no one said taxes (or politicians) were fair.

However, when Rishi was the chancellor and not PM, in his 2021 budget he said that the Lifetime Allowance would freeze until 2025/26, breaking the commitment made by a previous Conservative Chancellor. The Lifetime allowance is now frozen at £1,073,100, which means it won’t increase by inflation. Therefore, if inflation is 10% then it will NOT increase by £107,100. That means that people who have saved hard with large pensions valued over the Lifetime Allowance will pay the 55% tax on £107,100 extra!!

Now which group has the largest pensions? Probably long-term employees of the NHS. If you were a doctor, say aged 55, and had given your life to the NHS, but were told that every day that you stayed at the NHS your pension would be charged more tax, would you stay?

No wonder so many experienced doctors and consultants are leaving the NHS!

Wouldn’t it be good, if at least once, the politicians really thought through the implications of their actions? But we guess they would need to stay in power longer than the life span of a lettuce for that to happen!

Autumn Statement

The highly anticipated Autumn Statement happened last month, and to be honest, the government didn’t have much to live up to if the car crash that was the ‘mini budget’ was anything to go by!

Here’s a round-up of the most relevant bits:

- State pension payments to increase by 10.1%, in line with inflation

- Apart from in Scotland, the top 45% additional rate of income tax will be paid on earnings over £125,140, instead of £150,000

- Income tax personal allowance and higher rate thresholds frozen for a further two years, until April 2028

- Main National Insurance and inheritance tax thresholds also frozen for a further two years, until April 2028

- The annual tax-free dividend allowance will be reduced from £2,000 to £1,000 for the 2023-24 tax year and reduced again to £500 for 2024-25.

- The annual CGT allowance has been halved to £6,000 for 2023-24 and halved again to £3,000 for the following tax year.

- Stamp duty cuts announced in the mini-Budget will remain in place but only until March 31, 2025.

We are here to chat about how these changes may impact you if needed, so if you have any immediate concerns then please get in touch.

We plan to run one of our Tax Webinars in Quarter 1 of 2023 – Please Register your interest below:

RISK VS REWARD

We hear about this all the time – Risk vs reward! We must balance the fun of going on a boat, against the chance of seasickness. We balance the speed of driving around a corner against the chance of skidding out of control. We balance the benefit of that ‘one for the road’, against the hangover the following day. And when it comes to investing, it’s all about balancing the risk of losing money against making more.

The last three years have made it very hard to perform this balancing act. This is because of the pandemic and the Ukrainian war. Both of these were ‘Black Swan’ events and were not predictable. Therefore, performance over that period has been hard to achieve. However, Churchill said:

“Those who fail to learn from history are condemned to repeat it”

In saying that he meant we must learn from the past. And that is what we have been doing. Since February, we have amended the way that the Advanced Investment Strategy works. The foundations are the same with the objective being ‘above average performance with below-average risk,’ but to achieve this we have had to learn about the ‘new world.’

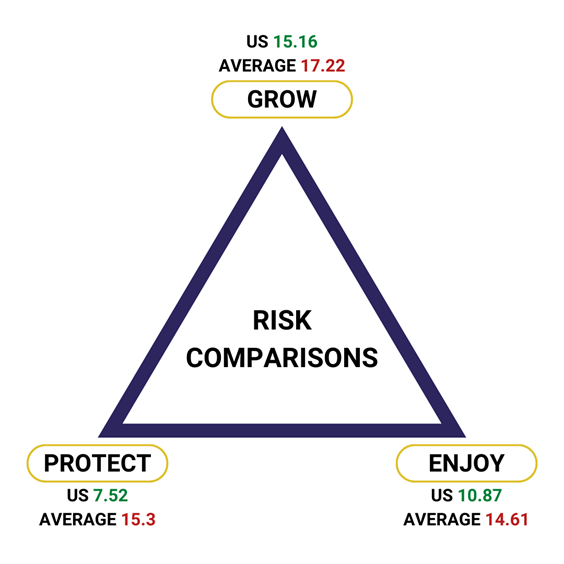

As you will have seen, the proof is in the eating, and things are tasting good. Not only have we produced above-average performance in all portfolios, but just as importantly, we have taken massively less risk than the average. Take a look at these figures.

What you can see here is risk measured by volatility. The green shows the risk that we have achieved, and the red is the average of others that do the same thing as us (as measured by the PIMFA benchmarks).

Clients of Penguin will have also seen in our recent communication that in the last 30 days, we have significantly beaten the average performance based on the same benchmarking measurements.

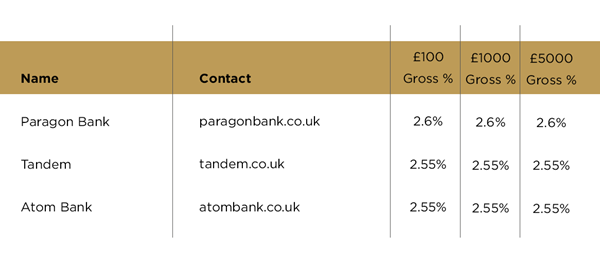

TOP THREE CASH ISA’s

Please check the terms and conditions before opening any account. If in doubt, consult with your financial adviser directly, as the above is for your information only.

Source: Moneysavingexpert.com 24.11.2022.