Wealth Management Update October 2022

HOW WILL PENSIONS CHANGE?

Mr Opperman was relieved of his duties by former Prime Minister Liz Truss on 8th September.

Mr Burghart’s appointment is one of the first ministerial appointments to be confirmed by the King.

As Parliamentary Under Secretary of State in the Department for Work and Pensions, Mr Burghart’s responsibilities will be the same as his predecessor. He has previous experience with the Department for Work and Pensions, having served on the Work and Pensions Select Committee.

It would seem that this new minister actually has some experience in something that he has been put in charge of, which could mean that he may actually do something.

If he does here is our wish list:

1. Remove the Lifetime allowance, which restricts how much people can save into pensions over their lifetime

2. Allow pensions to be gifted to children during the individual’s lifetime

3. Remove the annual allowance, which restricts how much people can save into pensions each year

4. Remove the link between personal pension contributions and earnings

5. Re-instate the ability of ‘carry back’ contributions to previous the previous six tax years

6. Remove the link of the tax year and pension contributions

7. Remove the age 55 benefit restriction (people are adults and should be treated accordingly)

8. Stop changing the rules to make things worse.

This is just a start, there are plenty more!

INHERITANCE TAX TAKES MORE MONEY FROM FAMILIES

Last month the HMRC announced that the income from IHT increased by 11% to 2.9bn (FTAdviser).

In the grand scheme of things, this is a trivial level of income to the government and is less than 2% of the money that Liz Truss proposed to spend to artificially keep energy prices down.

The strange thing is that for 20% of the people that pay it, they are so wealthy that it won’t make any real difference to their families. However, for the other 80% it will literally take away money that could have sent grandchildren to university, or paid the deposit on their first house, or even helped them start their own business.

For most people, taking 40% of everything over the allowances is a terrible thing, especially after you have paid tax on it to earn it in the first place.

If what you have is worth more than £1m, please check the arrangements that you have in place now, to make sure you are not paying more than is fair. If we have not written your Will, and have not put your estate plan in place, call us now and we’ll give you a second opinion. It could make a real difference that will allow your great great grandchildren to benefit.

CAN THE BANK OF ENGLAND WIN?

In September, the Bank of England raised interest rates by 0.5% to 2.25%. But why? And more to the point was it pointless?

The question we must ask is why did they increase interest rates?

The Bank of England has been independent since Gordon Brown was chancellor and is responsible for inflation, not as some think, the economy. It is given the sole responsibility to keep inflation low.

Inflation is a simple result of supply and demand and is affected principally by spending and money supply. Keeping it simple, the more spending there is in an economy, the higher the rate of inflation. The more money in an economy, the higher the rate of inflation. The less ‘stuff’ there is for people to buy, the higher the rate of inflation.

During COVID, the governments of the world flooded the world with money to stop their economies from crashing. This money is now in the world economy, and so inflation MUST go up. We have predicted this since the summer of 2020. There is nothing unusual here, and it will be short lived, once a full cycle of the money has been completed. The spending ‘boom’ post COVID, also contributed to this.

Then the Ukraine war happened. This has caused massive shortages around the world of certain resources, but mostly, wheat, ammonia, gas, and oil. Add this to the increase in money supply, and inflation increases.

This is why the Bank of England raises interest rates. When the rate is increased the rate of borrowing increases, and people tend to spend less. As they spend less, that falling demand reduces inflation. Simple!

Until politicians get involved…

Therefore, the acts of the Bank of England can get cancelled out by the acts of the government and inflation continues to be higher for longer.

As we have always said, the politicians, mess up economics!

MINI BUDGET – THE HEADLINES

There were quite a few changes so below are the ones we think you will want to know about the most.

Income tax

- Cut in basic rate of income tax to 19% from April 2023

- The proposed cuts for the higher rate income taxpayer, has now been reversed

National Insurance

- Reverse recent rise in National Insurance (NI) (£1.25 in the pound) from 6th November 2022

- New Health and Social Care Levy to pay for the NHS will not be introduced

Corporation tax

- Cancel UK-wide rise in corporation tax, which was due to increase from 19% to 25% in April 2023

Stamp duty

- No stamp duty on first £250,000 and for first time buyers that rises to £425,000 – comes into operation immediately

Energy

- Freeze on energy bills

Shopping

Planned increases in the duties on beer, for cider, for wine, and for spirits cancelled

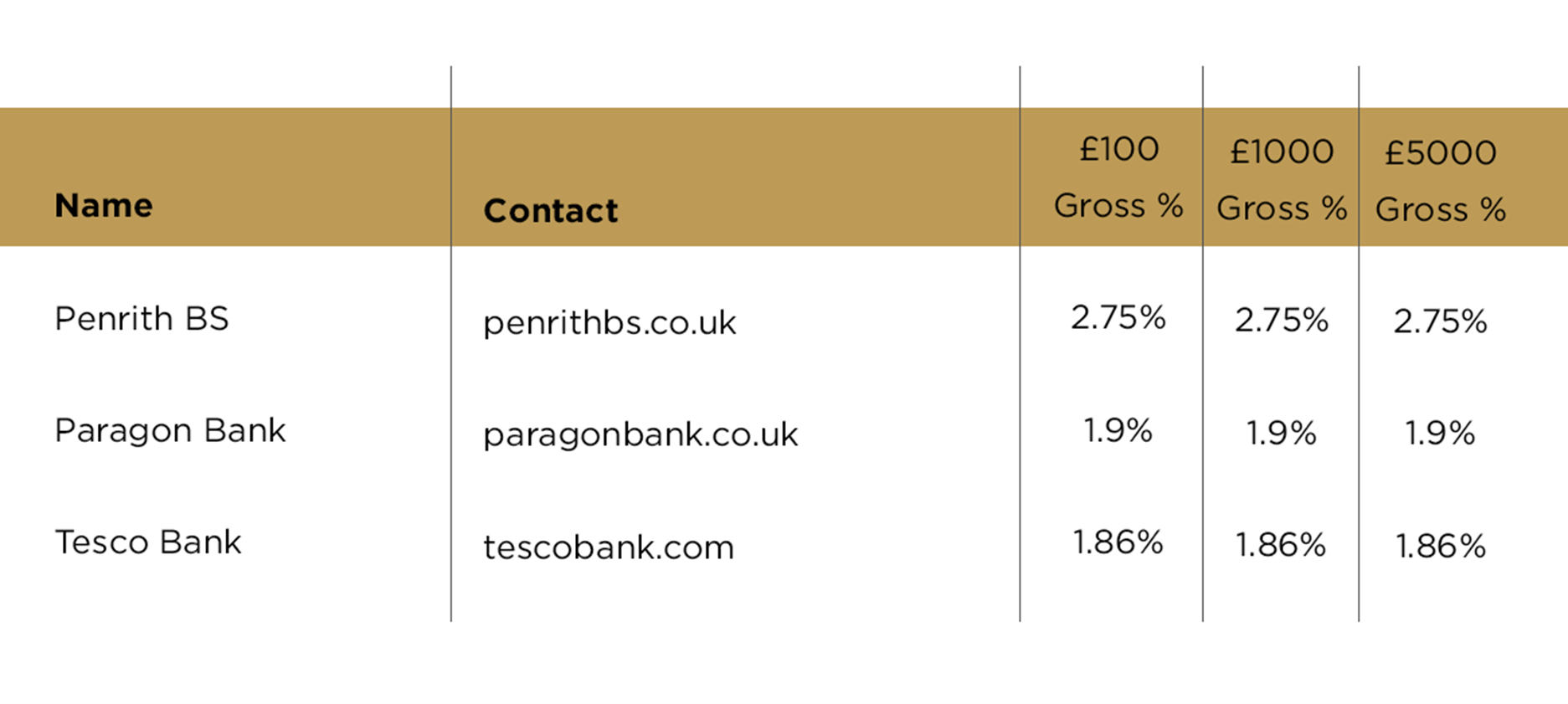

TOP THREE CASH ISAs

Please check the terms and conditions before opening any account. If in doubt consult with your financial adviser directly as the above are for information only.

Source: Moneysavingexpert.com 04.10.2022.