| CRYPTOCURRENCY SCAMS

With the markets producing effectively no return in the last three years, many frustrated people have turned to Cryptocurrency, to try and boost their returns. Unfortunately, everyone that we have met (so far) has made losses, some significant. To demonstrate, Bitcoin has lost just over 70% of its market value since its height in 2021.

That said, for the fearless investor who can afford to make big losses, there may be a place for the currency trading of bitcoin, which is effectively what you are doing.

One of the challenges is knowing how to invest and not getting ripped off by those looking to take advantage of you.

Fraudulent scams, within the cyber-currency world, spiked during the pandemic as more of us spent more time online.

Frauds reported to the UK Police Unit Action Fraud rose by a third in 2020 to the value of £2.3bn, and sadly the trend doesn’t look like it will be disappearing anytime soon.

Scams come in all shapes and sizes, ranging from cold calling and texting, to cyber fraud, and focusing on everything from Insurance to Pension and charity scams.

Fraudsters have used the promise of too-good-to-be-true Investment returns, or ‘get rich quick’ schemes, as the basis for many scams over the years. But they also react to the world around them, taking advantage of media reports to ‘catch’ investors’ interest.

Whether you’re 25 or 75, remember that any so-called opportunity promising sky-high returns is probably too good to be true.

Here are some tips to think about if you are looking to take a risk on crypto:

- Cold calls – beware of unexpected calls claiming to be your bank, HMRC, or us!

- Pressure to send payments – if anyone asks you to send a payment or move your savings, and pressures you to do it quickly – it’s probably a scam.

- Intercepted messages – be careful of the emails and messages you’re sending and receiving as they can be intercepted. Look out for anything unusual.

- Security details – never disclose your full security details over the phone. We’ll never ask you to do that and it’s very unlikely other companies will either.

- Ask questions – just because someone knows your basic details (like your name and address), doesn’t mean they’re genuine.

Most importantly, trust your instincts. If it feels wrong, it probably is wrong. Fraudsters are clever, and remember for them, conning you is a full-time job.

INTEREST RATES SET TO RISE?

Interest rates in the UK are set to hit 4% by this time next year if Liz Truss’s government cuts taxes and increases their spend of defence, according to Bank of America.

Their research, released this month, shows an expectation of the Bank of England raising interest rates in its meeting next week before doing the same again each month up to the end of the year.

Bank of America noted in their research;

“By lowering peak inflation we see the government’s energy price cap allowing the BoE to avoid increasing the pace of hikes,”

In a month that saw the Office for National Statistics report inflation hitting close to 10% in the 12 months from August 2021-2022, The Bank of America estimated annual government spending to rise by £40bn and then £50bn in 2026 and 2027. The news falls on the back of Liz Truss having promised around £30bn in tax cuts annually as part of her campaign to become Prime Minister.

Truss’ approach sits in contrast to that proposed by her main competitor Rishi Sunak, who said he would work to get inflation under control before looking to cut any taxes. Truss’ pledges include cancelling a planned rise in corporation tax, abolishing the social care levy as well as the green levy on energy bills – pledges that many considered fiscal irresponsibility.

100 DAY FAMILY TRUST

In the last few years, we have dealt with a number of deaths and helped many families when they are at their lowest emotional points. Throughout this, we have noticed that there always seem to be two issues:

1. The emotional distress of losing a loved one

2. The practical issue of access to money in the first 100 days

To deal with both issues and help families even more, we have created the 100-Day Family Trust. This Trust is designed to hold an amount of funding to help the family get through the first 100 days following death because, no matter how hard we try, assets and bank accounts get frozen, logins get misplaced, and third parties refuse to deal with families until their ‘post death’ process is complete.

In our experience, the amount of stress removed by having an immediate amount of money available is invaluable when we consider the more significant issue of grieving a loss.

With the money side of things covered, we thought it was important to capture the more emotional side of life, something just as valuable as cash in the bank. So, in addition to the Trust, using a carefully designed questionnaire, we aim to obtain all the wisdom that you have built in your life so that it can be saved for generations to come.

By building these insights into the 100-Day Family Trust process, the family will receive this information at a time when they need it most.

Typically, the Trust will include areas such as:

- The lessons that I have learned in life

- How I want my family to live their lives

- The most important lessons that were passed down to me

- How the wealth that will be inherited should be used

We believe that almost everyone could benefit from this type of arrangement, so please get in touch to speak to an Adviser for more details.

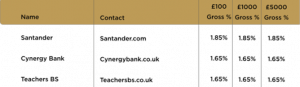

Top three cash ISAs

Please check the terms and conditions before opening any account. If in doubt, consult with your financial adviser directly, as the above is for your information only.

Source: Moneysavingexpert.com 14.09.2022. |