Wealth Management Update – January 2021

Lasting Power of Attorney’s go online

In the August 2020 Wealth Management Update we mentioned the possibility that the administration of LPAs would move online and it seems all the hard work by the Office of the Public Guardian (OPG) (likely urged forward by the need to be more online during the pandemic) has paid off!

The OPG has been working closely with a range of organisations, including HSBC UK and the Department for Work and Pensions (DWP), to develop the service and has announced the ‘Use a Lasting Power of Attorney’ service. This allows donors and attorneys to give organisations access to view an online summary of an LPA.

Once an LPA is registered, attorneys and donors will be sent an activation key. They can create an account online at https://www.gov.uk/use-lasting-power-of-attorney and use the activation key to add LPAs to their account. A donor or attorney can then create an access code which they can give to organisations.

Anyone who has had to register an LPA with an institution will know how long it takes to get through to the right department, to send in the original LPA, to wait for it to be loaded on to their system and for them to process it, then to wait for the original LPA to be returned to you before you can tackle the next institution, all the time not being able to access or manage the donor’s assets … it is making us tired just thinking about it.

These long turnaround times should hopefully be reduced to days using the online service, resulting in the Lasting Power of Attorney being registered much faster and without having to rely on original documents making it safely to their destination.

We hope institutions will see this as a leap forward in the use of LPAs and a vast improvement on any existing system. With luck they will all adopt the new system and start using it immediately to make donor and attorney lives easier.

Currently you can only use this service for LPAs registered in England and Wales on or after 17 July 2020. However, as we mentioned last year, this is likely to be extended to those registered in previous years … watch this space.

Click below to watch the two videos recorded by Managing Director and founder of Penguin about the Lasting Power’s of Attorney available to you and what they mean.

What is a Property and Affairs Lasting Power of Attorney?

What is a Health and Welfare Lasting Power of Attorney?

LV takeover confirmed

Bain Capital, a private equity group, has agreed a deal to buy LV for £530m. The sale will mean that LV will be demutualised and therefore will no longer be owned by its members. This, in turn, means that some of the 1.3m members of LV will receive modest cash pay-outs to be decided by the board, as well as higher encashment bonuses for those who hold With Profits policies, to compensate them for the loss of ownership. The amount payable will depend on each specific policy rather then being generic across the board.

Following the sale, the With Profits fund will be closed to new business but LV will continue to sell retirement and other products.

If you have a With Profits policy with LV that you were considering encashing soon it may be in your best interests to wait until everything is finalised, probably towards the end of 2021 or early 2022, so that you benefit from any uplift that may be applicable. This decision will be based on your specific circumstances, so if you have one of these policies please get in touch and one of our advisers will be able to help with advice and ultimate decision making on this.

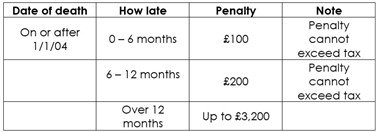

Inheritance tax – Chargeable penalties

Now more than ever it is important to be on the ball with any outstanding inheritance tax. HMRC have imposed an initial deadline of 12 months from the date of death for you to submit the relevant inheritance tax account. In the current climate it is important to factor in additional delays caused not only by the postal system and institutions but also potential delays within HMRC itself.

If you submit the inheritance tax account 12 months or more after the initial 12-month deadline, the fine can increase from the standard £100–£200 late filing penalty to up to

£3,200 in total. The main penalties that you may need to be aware of are:

Please contact your Adviser if you want to ensure that you avoid incurring any unnecessary late fees.

House prices see highest growth in six years

House prices rose by 7.5% throughout 2020 – surprising in the current circumstances but welcome news for homeowners.

The furlough and self employment income schemes provided vital support to the market and the cost of borrowing remained low because of a whole host of factors and so kept available credit flowing. Coupled with the fact that lenders were able to offer payment holidays to borrowers to help them remain in their homes meant that the property market ended 2020 on a high.

Without doubt, the stamp duty holiday has also been a stimulus to the market, as lenders approved more than 100,000 mortgages in November – the most in 13 years! However, it has also been helped by the public’s desire to have more space for their families, both inside and out, as the pandemic has restricted people to their homes for most of 2020 and potentially a chunk of 2021.

Competitive mortgage rates are still available and lenders are starting to allow smaller deposits again, having increased the minimum required during the height of the pandemic. However, both lenders and conveyancers are struggling to keep up with demand and all currently have a backlog of requests. This means that some buyers may potentially miss out on the stamp duty holiday they were hoping to get.

Whilst the outlook for 2021 remains uncertain, especially after the end of the stamp duty holiday on 31st March, hopefully as the vaccine continues to be rolled out there will be increasing stability across all markets.

If you’re looking to buy your first home in 2021, re-mortgage, purchase a commercial property, or start renting out your property, please contact us today and the Penguin Mortgage team will be more than happy to help.

NS&I complaints

As a result of poor service levels from NS&I in recent months MPs have ordered NS&I to investigate because of the anxiety caused to many of its customers.

When NS&I recently slashed the chances of winning on Premium Bonds and dramatically cut interest rates across all products, consumers were eager to move their funds to higher paying providers. However, when customers attempted to withdraw their funds, they were met with long delays and reduced service, in part because of the pandemic but also because of poor management that was already evident before the pandemic struck.

NS&I have recruited almost 200 additional customer service staff to try to improve their call capacity and overall service levels and hopefully this will help with future interactions. However, those who suffered difficulties during a time when their interest rates were drastically reduced may not be quick to forget their experience.

Please note: NS&I have decided to stop paying Premium Bond winners via cheque as of Spring 2021. Winnings will be paid directly into bank accounts in the future.

Do not forget self-assessment!

The deadline for submitting your 2019/20 self-assessment tax return is midnight on 31 January 2021.

Those who are late submitting their return face a penalty of £100, even if there is no tax to pay or if tax owed is paid on time. Additional penalties are due for continued late filing and late payments.

To get help with your Self Assessment please click here to be taken to our helpful step by step blog.

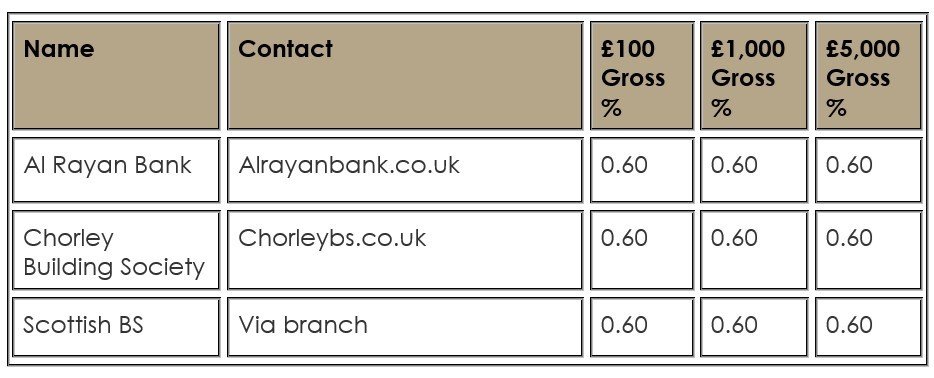

Top three Cash ISAs

Photo by olia danilevich from Pexels