Wealth Management Update – November 2020

The perfect storm: US Election, Brexit and the Virus

Confidence fell across the stock markets at the end of October, probably because three main events were happening at the same time.

US Election

Uncertainty over who would win the Presidential election caused turbulence in the markets over the last couple of weeks as the election drew to an end. People were reluctant to vote in person because of the current pandemic (fair enough!) and so the results took days to become clear as many opted for postal voting. The certainty of a decision rallied the markets in the short term but, as the world hates change, any rally will probably be short-lived as the uncertainty surrounding a new president sets in. Longer-term growth will depend on the policies and packages they implement.

Brexit

For a second there I think we almost forgot about Brexit – a global pandemic can do that, apparently. The continuing uncertainty around ‘deal or no deal’ is adding to market unrest. If it becomes clear that a ‘deal’ will not be possible, then we must hope for compromise and transitional arrangements between the UK and the EU that would mean a shockwave is not felt throughout UK businesses and worldwide markets. Whatever happens, we will get through it.

The Virus

With infections on the rise and various national lockdowns coming to an end or getting underway – depending on where you live, COVID 19 is having an impact on what little growth we managed to reclaim over the summer. Restrictions, whether local or national, are not good for employment or consumer spending and, paired with a sense of fear and a lack of confidence, this is all bad news for the markets.

To end on some good news: according to the World Health Organisation there are 192 vaccine candidates of which 40 are being clinically evaluated and 10 are in phase three trials, which is the last stage before approval. If one or more of these is found to work, then Europe and the USA could start to feel more normal by the second half of next year. Now that would be good news.

How to cut your Inheritance Tax

If you have worked hard all your life to accumulate your wealth and have duly paid your tax, the last thing you want is to pay even more tax when you die. Over £5.1 billion was paid in inheritance tax (IHT) last year; a hefty chunk of people’s lifetime wealth and their descendants’ inheritance paid to HMRC.

Luckily, there are some very simple steps you can take to reduce your IHT bill.

1. Write a Will

Take advice about your Will. Many people think Wills are straightforward documents that anybody can write, but how they are written can make a difference to how much tax you pay. For example, if you are married and you have a Will that passes everything to your spouse you benefit from the spousal exemption and there is no IHT payable on first death. The surviving spouse can then carry forward the unused NRB and RNRB for use when they ultimately pass away.

Don’t rely on the Rules of Intestacy, it is likely these will not be suitable or achieve what you want.

2. Make full use of the RNRB

The introduction of the Residence Nil Rate Band (RNRB) in 2017/2018 has resulted in a reduction of IHT for thousands of households. However, it is important to take specific and accurate advice on how to pass your estate after your death and specifically to make use of the new RNRB allowance relating to your home. There are many ways this can be incorporated into your estate planning so that it works best for you.

3. Use your gifting allowances

There are many gifting allowances that are underused. The link below lists them in more detail. However, gifting should be discussed as part of your overall financial plan to ensure it doesn’t have an impact on other areas of your finances.

Trusts should also be considered for larger lump sum gifts that are subject to the 7-year gifting rules.

www.gov.uk/inheritance-tax/gifts

4. Don’t forget your pension

Pensions pass to your beneficiaries free from IHT, so consider if income can be taken from elsewhere rather than from your pension. This will mean the pension can be preserved for your beneficiaries. Pensions are extremely complicated so make sure you get advice on your individual situation.

5. Skip a generation

Skipping a generation and leaving cash to grandchildren reduces the risk of being taxed twice.

The underlying message here is that there are many options open to you to potentially save IHT, but make sure you get advice specific to you and your situation. This will ensure you get the best tailored solutions to suit your needs.

Missed our recent webinar dedicated to helping you protect your Money, Assets, and Estate for future generations? Fear not! You can re-watch the webinar here, don’t forget to email info@penguinwealth.com for any extra questions and to find out more.

Watch webinar: How to protect your Money, Assets, and Estate for future generations

Bank of England swerves negative interest rates

We touched on this back in June as the world pondered whether the Bank of England (BOE) would be forced to introduce negative interest rates in the UK. The BOE did write to all banks asking them to provide details of how they would manage if interest rates were reduced to 0% or even into negative figures.

If the BOE had decided to dip into negative interest rates it would have raised the possibility that banks will also start to charge savers to hold their cash in current accounts! However, for now, the BOE has instead voted unanimously to increase its purchase of UK bonds by £150 billion and keep interest rates at 0.1%, effectively injecting that cash back into the UK economy. This additional quantitative easing has been implemented by the BOE to support the economy and to try and ease the intensity of the unavoidable slowdown caused by the pandemic.

The BOE stated that the overall outlook for the economy was ‘unusually uncertain’ and would depend heavily on the developments surrounding the pandemic as well as the outcome of talks regarding Brexit. There is some optimism for 2021, where it is expected that Brexit will have a conclusion and restrictions regarding Covid-19 will have been eased.

Avoid missing out on savings interest

Last month we mentioned that NS&I had dramatically slashed their rates, causing quite a stir. In light of this, it was reported that more than half of us cannot be bothered to switch our cash savings accounts and as a result, between us, we are missing out on £3.5 billion in interest.

When rates are so low we get less excited about cash savings and are therefore less inclined to shop around for the best interest rates, put off by the hassle involved and unconvinced that it is worthwhile.

However, in the long run it would be worth it! If you have a savings account with the same bank you hold your current account with, they normally offer you a terrible 0.01% interest rate. Saving £10,000 therefore makes you £1 after a year. There are rates of up to 1% still available for instant access, notice accounts and fixed rate accounts that, based on the example of saving £10,000, could offer a £99 improvement on return.

If you have not switched your cash savings in a while and they’re earning next to nothing, now is the time to get on the comparison sites and dig out the best deal. Considering the prospect of negative interest rates potentially coming into play, more thought should probably be given to fixed rate accounts to lock in those higher rates for longer; only if these are suitable for your situation!

If this still doesn’t seem like enough for you, give us a call to chat about any savings you have on deposit to see what we would recommend for you in terms of investing, in a bid to achieve higher growth over the long term.

Will expats’ pensions be hit hard post Brexit?

Those living abroad but with British pensions could face complications when Brexit happens in December this year, as banks say they may be forced to close expats’

accounts if they can’t update their systems ready for 31st December.

This would mean those who are retired and receive pension payments into such a bank account could be left in limbo without access to their pension savings. Alternatively, those affected may be forced to re-route their retirement funds through accounts held in European banks, leaving them exposed to hidden fees, poor exchange rates and low interest rates.

Advice to those expats affected is that they should contact their bank and pension provider to find out what their options are. If possible they should prepare to have enough funds available to cover living costs without accessing their pension or, at a minimum, have sufficient funds to last a few months into 2021 to allow time for the situation to be investigated and resolved.

Also, be aware of potential scams surrounding this topic as we move closer to December. Providers will be on high alert and this is likely to cause delays with any pension transfers or bank account switching.

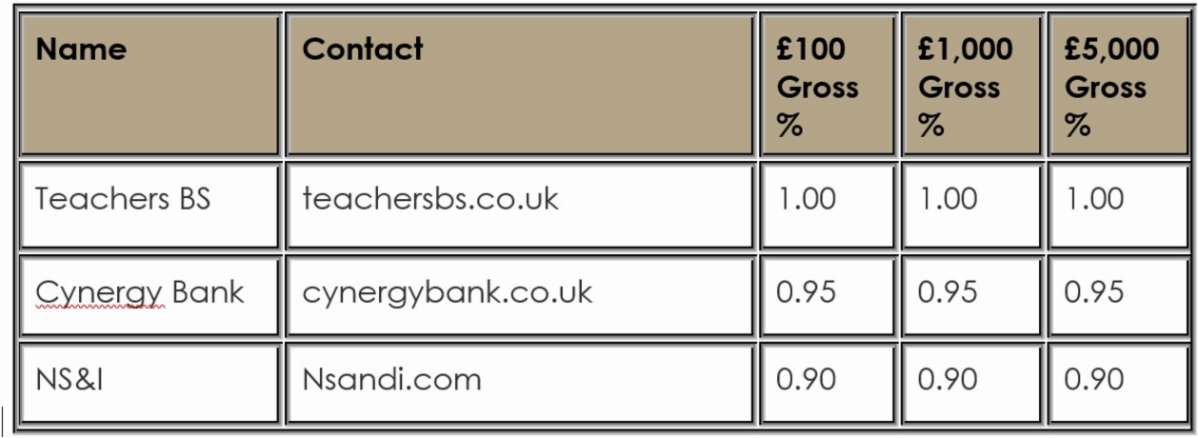

Top three Cash ISAs

Please check with the terms and conditions before opening any account. If in doubt consult with your financial adviser directly as the above are for information only.

Source: Moneyfacts Magazine November 2020 Edition

Feature image source: https://www.supermarketnews.com/issues-trends/look-issues-2020-presidential-election-impacting-supermarket-industry