Wealth Management Update – July 2019

How to prepare for the worst…

We know how difficult it can be for families when they lose a loved one, and it is not a subject people are overjoyed to start a conversation about. Consequently, loved ones can find someone’s passing not only emotionally distressing but also practically very stressful.

For example, how many of you have told your families where your Will is kept? Or, if it’s in a safe, what the combination of the safe is? Or what life policies you have that they need to know about so they can have financial support?

It is always something we think we will do later, until we never really get around to doing it at all. That is why we are encouraging our clients to complete our Life Book, or something similar – a book of all the practical things your loved ones will need to know when you are no longer here. The Life Book is a place to record information that will be so helpful to them at such a difficult time, and a means to communicate it to them without having to speak about it directly, if you prefer not to.

It is not limited to practical information either, there is a section in the Life Book for those stories and anecdotes or thoughts and feelings that you may or may not have shared with them previously, but that you want them to remember after you are gone; things that they can relive with others around them as a memory of you.

All clients who have some kind of estate planning with us, be it simply a Will or a whole host of complex trust arrangements, will have received a copy of the Life Book to help them put their thoughts and affairs in order, ready for their families to deal with after they have gone. A client of ours recently lost her husband and said that she found the Life Book to be a great help.

Even if you don’t like the thought of a whole book of information, or find that overwhelming, we urge you to start writing things down, making records and memories to pass on to future generations as part of your legacy.

Dying intestate, what “Will” happen?

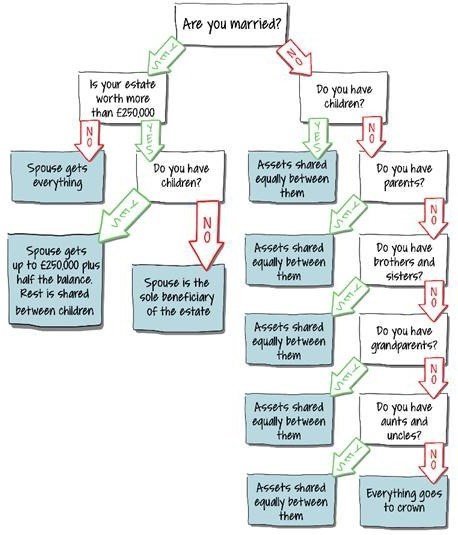

When you die without a Will, you die “intestate”. This means that your estate will be subject to the “Rules of Intestacy” which dictate how the estate should be divided up. As you can see from the diagram below, the beneficiaries of the estate vary depending on the value of the estate being passed and your family situation. If someone dies without a Will, it is usually assumed that the surviving spouse will be the sole beneficiary of the deceased’s estate, which, as you can see below, is not necessarily the case. If, for example, you are married with children and die intestate, your estate would be split between the survivor and your children (generally speaking). If you were married and were to die intestate with no children, the assets would be split between the survivor and the next beneficiary in line, which would be your parents and, eventually, the crown!

If you do not have a Will, your estate could pass to the wrong beneficiary! If you are unmarried, or not in a civil partnership, you or your partner won’t inherit if either of you passes away, and this could potentially result in the survivor having to sell the property to meet the rules of intestacy. It is therefore essential that you have a Will in place so that your estate passes to the right people and, most importantly, to help those you leave behind to deal with your affairs. Your loved ones must deal with the pain of you passing away, but it would be even more painful for them to be left behind with no instructions from you on how you want your estate divided, forcing them to apply to the courts to appoint a personal representative.

If you do not have a Will or have existing Wills and wish to make amendments, then please contact the office and speak to a member of the

Team who will be able to help you on 02920 450 143.

DIY disaster…

Hargreaves Lansdown has always been a Woodford supporter and they have been hit hard by the closure of Neil’s fund. They have removed it from their recommended fund list and the CEO has issued an official apology to those trapped in the fund. This comes after their Head of Research Mark Dampier and his wife sold their Hargreaves Lansdown shareholdings a mere 3 weeks before Hargreaves became entangled in the Woodford troubles, saving themselves £1.15 million more than if the sales had been made 3 weeks later. Mr Dampier has been cleared of any official wrongdoing as he was acting merely on the growing scrutiny of the fund’s stability, but there are questions over the morality of his decision to not inform Hargreaves’s clients of this growing concern so they, too, could take action.

Penguin has never invested in the Neil Woodford’s funds or a company that he set up a few years ago – we invest only in the best funds available in each sector, something that we monitor on a daily basis. Across the entire business, we are all invested in the same funds, in different denominations and risk profiles to suit our objectives. All profiles are managed by our overriding strategy and so, if our fund management team are concerned enough to move out of a fund, ALL of our staff and ALL of our clients move with us, nobody is left behind.

This is one of the main differences between using a primarily DIY platform service such as Hargreaves Lansdown and using a financial advisory firm like ourselves which provides an active form of asset management, and one that really values the wellbeing of their clients and their clients’ hard-earned savings.

Part 3 of 4 – ISAs: Tax benefits of ISAs explained

What is the tax benefit of holding your investments in an ISA, as opposed to any other account?

Arguably, the most relevant and most effective benefit is that when you come to withdraw the funds from the account they are not subject to income tax. Any growth in the investment is also immune from capital gains tax. So, in summary, in an ISA your investments can grow tax-free or receive interest tax-free and then when you come to take them out, there is no income tax applied, regardless of the amount withdrawn.

Now you see why the government limits your contributions into an ISA to

£20,000 per year! It is such a valuable tax-efficient account to have. Plus, you don’t have to declare it on your tax return – that is always a bonus.

One of the main things to remember about ISAs is that if you want to change your ISA provider do not withdraw the funds! As soon as funds are withdrawn, there is no guarantee that either the existing or the new provider will allow you to reinvest the full amount, as not all providers employ the flexible ISA rules that allow you to reinvest the money you withdraw in the same tax year.

For example, you have £100,000 in an ISA and you want to move it to a different provider. If you withdraw the funds in full to your bank account, the new provider may not employ flexible rules and may only allow you to invest any annual allowance that you have remaining (max. £20,000). The remaining £80,000 would have to be placed in a different account, which would likely be less tax efficient.

If you want to change providers make sure that you do so by means of a transfer – this allows you to transfer the full amount of your existing ISA (no limit on the amount) to a new provider; of course, you will first need to check that the new provider is willing to accept it.

If you don’t have an ISA but think you should (you probably should at least consider it), contact the office and we can see if it would be suitable for you.

Woodford fund in trouble

Neil Woodford has not had a great month! With the closure of his flagship fund and the loss of his key client, St James’s Place, things have gone from bad to worse. At its height, his flagship fund was worth £10.2bn, now reduced to below £4bn – a result of underperformance that saw big hitters heading for the door in droves, to the tune of about £9m per day!

Opinions are divided over Neil; he is the marmite of the financial world – his supporters adore him but those who do not agree with his methods or strategies deplore him absolutely. No matter your opinion, some of the “goings on” are certain to raise eyebrows.

Pensions in real life

In May this year there was a great programme on ITV called Tonight – Pensions: Are You Saving Enough? It is available on YouTube

(https://www.youtube.com/watch?v=qDQZGHPFOAo) and is well worth watching.

The programme stated that one in four people are not saving enough into their pension or don’t even have a pension (if they are not covered by auto enrolment). With the average pension pot for males in the UK at £179,000 and for women £35,800, it is clear that as a nation we are not saving enough into pensions – a point we make regularly so that you, but also your families, can be aware this is something they need to plan for.

The programme challenged three people to live on their projected pension amounts for a week, based on what they are saving now (minus any projected bills):

- A 45-year-old male, who only started paying into a pension at age 40 at a rate of £75 per month, which his employer matches (£150 per month total contribution).

- He received £42.50 disposable income per week.

- A 38-year-old female, who has an NHS pension from 16 years of service, who is now self-employed and saves £400 per month into a pension.

- She received £270 disposable income per week.

- A 21-year-old male, who is self-employed and doesn’t pay into any pension.

- He received £42 disposable income per week.

One of these people paid for financial advice, and not surprisingly it is the female of the group who saves the most into her pension and receives the most benefit in retirement. The programme really highlighted the benefit of getting sound Independent Advice from a Financial Planner. Be wary of those planners who are employed by specific pension companies as they will be financially rewarded for their sales by the provider and will, therefore, be more motivated to sell you specific products.

In a world where 51% of people prioritise home improvements and holidays over their retirement pot, it really is imperative that we pass on to future generations the importance of saving into a pension for their financial independence.

To find out more about the show, details are available at the following

website: https://www.itv.com/news/2019-05-09/pensions-are-you-saving- enough-tonight/

Please do pass our book The Wealth Secret on to anyone who you think may need further education on the importance of saving or planning for the future. You can download your free copy of The Wealth Secrete HERE.

LPAs set to go paperless!

The Office of The Public Guardian (OPG) is the latest institution to join the paperless revolution and has announced that the business plan for 2019-2020 includes how to move “online” with Lasting Powers of Attorney (LPAs).

In a bid to make things more accessible, flexible and simple for clients the OPG is focusing more on digital services, although I am sure that there will be trials and errors along the paperless journey.

Watch this space for more updates, but it certainly takes a lot of paper to set up LPAs at the moment and this change will likely save money, time, the environment and be a step in the right direction in terms of technology.

Notes on Brexit

There is still little movement on the Brexit horizon; everyone is currently gripped with the Tory leadership battle between Boris Johnson and Jeremy Hunt. Part of Mr Johnson’s campaign is a promise that we will absolutely definitely be leaving the EU by 31st October, even if it is without a deal. How he plans to get that through Parliament when MPs have demonstrated that they are dead-set against no deal remains to be seen.

Meanwhile, in Brussels, President of the European Council Donald Tusk has once again confirmed that the EU are not willing to reopen negotiations over Brexit. As far as they are concerned it is May’s deal or no deal, something MPs just can’t seem to get their heads around.

|

|

| BEST SAVINGS SELECTION |

|

|

| Top three Cash ISAs

|

| Please check with the terms and conditions before opening any account. If in doubt consult with your financial adviser directly as the above are for information only.

Source: Moneyfacts Magazine July 2019 Edition |