Wealth Management Update – February 2021

Use it or lose it – it’s that time again

And just like that we are already in February. Where does the time go?

As it is February there are only two more months to utilise your ‘use it or lose it’ tax allowances. Below are listed the most common allowances that cannot be carried forward and so will be lost if not used by 6th April 2021.

Personal Allowance – this tax year the maximum personal allowance is £12,500, though the amount will vary between individuals. Whatever your personal allowance, do not miss out on using it. If you are planning any taxable withdrawals it may pay to bring them forward, or withdraw up to your taxable allowance and invest it into your ISA.

ISA Allowance – everyone has an allowance of £20,000 to invest in an ISA for the 2020/2021 tax year. As ISAs offer tax-exempt growth and withdrawals, this is usually the first allowance to be used. It may be sensible to consider whether other less tax-efficient investments could be encashed to generate funds to use the ISA allowance. Don’t forget, this allowance is the maximum allowed per tax year across all ISAs, LISAs, etc., that you have.

Annual Allowance – you can usually invest a maximum of £40,000 (or the maximum of your total earnings, if lower) into a pension arrangement each tax year, providing you have not accessed your taxable benefits previously. It is also possible to carry forward an additional 3 years of allowance if you do not use it – but there are rules around this so get in touch with us before you take action.

CGT Allowance – each tax year you can crystallise gains up to the annual exempt amount with no CGT to pay, this year (2020/2021) it is £12,300. Where losses have been realised in the same tax year these offset any gains before the exempt amount. If no gains were crystallised this tax year, then the loss can be carried forward and offset against gains in future years. But remember you can only carry forward losses, not the actual allowance!

IHT Exemptions – an individual has an annual exemption for lifetime transfers of £3,000 per tax year, which can be given away to anyone. This can be carried forward one year, so if you didn’t make a transfer last year you could give away £6,000 this year. There are more IHT exemptions, the details of which you can find using this link: https://www.gov.uk/inheritance-tax/gifts

To help you keep more of your money at the end of the 2021 tax year we’re running a free webinar on February 23rd at 9am and 1pm. We’ll be giving you the hints and tips you need to make sure you’re using all the Tax allowances available to you.

This whistle stop tour of the Tax system will run on Zoom and is available to everybody, so be sure to invite friends, family, colleagues, and other people within your network.

There’s a common misconception that year-end Tax Planning is for the super-wealthy but it is, in fact, for everyone that wants to use the Tax year to their advantage.

If you…

-

Have an ISA

-

Pay Tax

-

Pay into a Pension

-

Have children over the age of 18

-

Want to claim more advanced Tax Allowances

Then click below and register your space before they fill up!

Book your space for February 23rd at 9am

Book your space for February 23rd at 1pm

Using these allowances may not be right for you, but if you want any further information on the above, or think you have allowances that aren’t being used, please get in touch. One of our Advisers will be more than happy to provide bespoke Advice tailored to your situation.

Brexit – day-to-day reality

We all know that Brexit will mean changes for pretty much everybody in the UK and EU. Some of these changes will be big and some will be small. But sometimes it is the small things that take you most by surprise.

It has become apparent that getting deliveries from the EU is not going to be as simple as it used to be. Despite the free trade deal agreed before Christmas, which promised to smooth the UK’s exit from the EU, new taxes and charges now apply to almost everything that goes back and forth between the two, and everything you purchase in the EU is subject to them. There have been numerous reports of people being asked to pay charges before their parcels will be delivered. If you spend less than £135 the charges are applied at the point you pay; however, if you spend over £135 the charge is applied when you receive the item.

This is a change to what we are used to, but if you want the item you have ordered then you have to decide if you are willing to pay the charge to receive it. However, note that the same rules apply even if the item is a gift to you. So don’t be surprised if you receive a gift from someone in the EU and you end up having to pay to receive it!

Are lost pension pots a concern for you?

According to figures from the Office for National Statistics (ONS), the value of preserved pensions – where no withdrawals or contributions are being made – rose to £291bn between 2016 and 2018. Although not all of that is expected to be ‘forgotten pensions’ but rather belongs to those who are waiting for retirement to access their pensions and are preserving them in the meantime, some of it is likely to belong to individuals who aren’t even aware of its existence.

There have always been concerns that people could be in danger of losing track of their pension pots when moving between jobs or by not updating their contact details when they move house. The Association of British Insurers (ABI) estimate there could be about £20bn of lost pensions, at least six times higher than previously estimated.

The Pensions Dashboard Programme was expected to be introduced last year to help people keep track of their savings, but the complexity of setting up the system means it has been delayed until 2023.

In the meantime, the Pension Tracing Service – the government’s free tracing service – is a great way for people to begin finding out whether they may have lost assets and where those assets may be now, See: https://www.gov.uk/find-pension-contact-details

The video below explains what a Pension really is and how it can be used!

When will younger generations retire?

Canada Life recently completed some research amongst 18–34-year-olds which found that the majority expected to work until age 70 and beyond. At first this was surprising but, when you think about it, is it really that unbelievable?

With the state pension age creeping higher and higher, it is becoming more likely that the traditional retirement age will follow suit. Whilst the introduction of auto-enrolment certainly initiated pension savings for some of the younger generation, this age group are still not as engaged with thinking about retirement savings as they should be. By the time they start to consider the importance of saving for retirement it may be too late, and they may not have the funds or the time to grow their pots to a level that will give them the financial independence they want.

At Penguin we love providing financial education, so if you have children or grandchildren who you would like to get started on their retirement savings journey, either by introducing them to us as a client or by making provision for them within your own portfolio, then get in touch and we will be more than happy to help.

What will the Bank of England do next?

The Bank of England (BoE) expects a return to some form of normality in 2021 and there have been forecasts anticipating GDP growth of 5.5%, the strongest growth rate for more than 30 years. However, there is the possibility that this could be derailed and, given the year we have just had in 2020, and 2021 so far, it is not surprising that nothing seems certain at the moment.

December’s Monetary Policy Committee meeting maintained the Bank’s key interest rate at 0.1% and unanimously agreed to hold corporate and government bond purchases at their existing levels. However, they did stress that the road to recovery depends on the “evolution” of the pandemic, the nature of post-Brexit trading arrangements, and the responses of households, businesses and financial markets to these developments.

It is likely the BoE will do nothing at the beginning of 2021 as the stimulus at the end of 2020 should take us through the first few months of the year. Hopefully by then the vaccine will have been successfully rolled out and we will be set up for a fairly decent recovery for the rest of the year as pent-up demand is released.

If the BoE does take action it is most likely to come in the form of asset purchases rather than negative interest rates, however negative interest rates remain available as a weapon in the BoE arsenal if required.

We are sure that, given past experience, by the time you read this everything will have changed. But isn’t that just the way of the world currently?

Pension transfer values up, but so are scams

Despite the turmoil in 2020, pension transfer values, for Defined Benefit/Final Salary Pension Schemes, ended the year up by 8%. Despite this rise transfer activity was down by 20%, with the recent pandemic creating feelings of uncertainty that left some investors loathe to make big changes.

Pension consultancies also noted that scams related to transferring away from schemes appeared to be at a record high. Many scammers focused on fee arrangements in new schemes to confuse investors into signing up to arrangements that could be detrimental to pension pots in the future.

This is just a reminder to be vigilant and always research a company before entering into a relationship with them. Remember, if it seems too good to be true, it probably is.

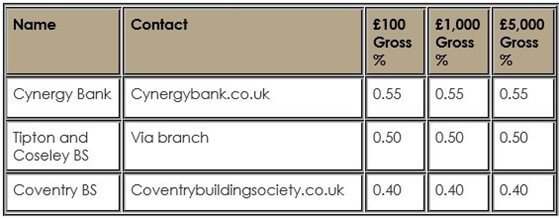

BEST SAVINGS SELECTION

Top three Cash ISAs

Please check with the terms and conditions before opening any account. If in doubt consult with your financial adviser directly as the above are for information only.

Source: Moneysavingexpert.com – 01.02.2021